Cracking The Code On CA CDTFA: Your Ultimate Guide

Alright, folks, let's dive right into something that might sound a little intimidating at first but trust me, it's not as scary as it seems. CA CDTFA, or the California Department of Tax and Fee Administration, is basically the tax police of California. They’re the ones who make sure everyone pays their fair share of taxes, fees, and all that jazz. Now, before you start panicking about audits or penalties, let’s take a deep breath and break this down step by step. Understanding CA CDTFA isn’t just about avoiding trouble—it’s about staying informed and compliant so you can focus on growing your business or managing your personal finances without unnecessary stress.

When people hear the word "taxes," they often get this deer-in-the-headlights look, but here's the thing: taxes are a part of life, especially if you live in California. The CA CDTFA plays a crucial role in ensuring that the state has the funds it needs to provide essential services like public schools, healthcare, infrastructure, and more. Think of them as the behind-the-scenes heroes who keep the state running smoothly. But hey, let’s not sugarcoat it—ignoring their rules can lead to some serious consequences, so it’s better to be proactive and informed.

So, why should you care about the CA CDTFA? Well, whether you’re a small business owner, an employee, or even just a regular Joe trying to file your taxes, this department affects you in one way or another. From sales tax to excise tax, they’ve got their fingers in just about every financial pie in the state. By the end of this article, you’ll have a solid understanding of what the CA CDTFA does, how it impacts you, and most importantly, how to stay on their good side. Let’s get started!

- What Does It Mean To Be Slu Footed Unveiling The Secrets Behind This Quirky Term

- Your Zodiac Sign On May 24th Unveiling The Secrets Of The Stars

Before we dive deeper, here's a quick roadmap to help you navigate through this guide:

- What is CA CDTFA?

- A Brief History of CDTFA

- Key Functions of CA CDTFA

- Types of Taxes Administered

- Tips for Staying Compliant

- Understanding Penalties

- Resources for Taxpayers

- Future Changes to Watch For

- Common Mistakes to Avoid

- Wrapping It All Up

What is CA CDTFA?

Alright, let’s start with the basics. The CA CDTFA, or California Department of Tax and Fee Administration, is the agency responsible for administering taxes, fees, and other financial obligations in the Golden State. Think of them as the tax wizards who make sure everything runs smoothly in the world of state revenue. Their job is to collect taxes, enforce tax laws, and provide guidance to taxpayers. It’s like having a financial watchdog that keeps everyone accountable.

Now, here’s the deal: the CA CDTFA handles a wide range of taxes, from sales and use tax to excise taxes on things like cigarettes and alcohol. They’re also in charge of fees related to environmental programs, fuel taxes, and even cannabis taxes. In short, if it involves money going to the state, chances are the CA CDTFA is involved in some way.

- Lily Young Restless The Rising Star Of Modern Music

- Ncis Los Angeles Spoilers Who Dies The Shocking Truth You Need To Know

Why is CA CDTFA Important?

Here’s the kicker: the CA CDTFA plays a vital role in funding essential services in California. The money they collect goes toward things like education, healthcare, infrastructure, and public safety. Without their efforts, the state wouldn’t be able to maintain the quality of life we’ve come to expect. So, while paying taxes might not be the most exciting part of your day, it’s definitely important for the greater good.

A Brief History of CDTFA

Let’s rewind a bit and take a look at how the CA CDTFA came to be. Originally, the department was known as the California State Board of Equalization, but in 2017, it underwent a reorganization and became the California Department of Tax and Fee Administration. The goal of this change was to streamline operations and improve efficiency. It’s like giving the department a fresh start with a new name and a renewed mission.

Over the years, the CA CDTFA has evolved to keep up with the changing economic landscape. They’ve adapted to new technologies, updated their systems, and expanded their services to better serve taxpayers. It’s kind of like a tech startup that keeps innovating to stay relevant in a fast-paced world. And hey, who doesn’t love a good success story?

Key Milestones in CDTFA History

- 2017: Reorganization into the CA CDTFA

- 2018: Introduction of new online services for taxpayers

- 2020: Expansion of e-filing options during the pandemic

Key Functions of CA CDTFA

So, what exactly does the CA CDTFA do on a day-to-day basis? Let me break it down for you. First and foremost, they’re responsible for collecting taxes and fees. This includes everything from sales tax to excise taxes on specific goods. They also enforce tax laws, which means they’re the ones who investigate potential violations and impose penalties when necessary.

In addition to their enforcement duties, the CA CDTFA provides guidance and support to taxpayers. They offer educational resources, answer questions, and help people navigate the sometimes confusing world of taxes. It’s like having a personal tax coach who’s always there to lend a helping hand.

How the CA CDTFA Helps Taxpayers

Here are a few ways the CA CDTFA supports taxpayers:

- Offering online resources and tools

- Providing customer service through phone and email

- Hosting workshops and seminars

Types of Taxes Administered

Now, let’s talk about the different types of taxes the CA CDTFA administers. There’s sales and use tax, which applies to most retail purchases. Then there’s excise tax, which is levied on specific goods like cigarettes, alcohol, and fuel. The CA CDTFA also handles cannabis taxes, which have become increasingly important as the state continues to legalize marijuana.

Oh, and let’s not forget about environmental fees. These are charges related to programs that protect the environment, such as recycling and waste management. It’s like a double win—taxes that help both the state’s finances and the planet.

Breaking Down the Numbers

Here are some interesting stats about the taxes collected by the CA CDTFA:

- Sales and use tax: $50 billion annually

- Excise tax: $5 billion annually

- Cannabis tax: $1 billion annually

Tips for Staying Compliant

Alright, here’s the part where I give you some practical advice on how to stay on the right side of the CA CDTFA. First things first: keep accurate records. This means documenting every transaction, keeping receipts, and maintaining detailed financial records. Trust me, it’ll save you a lot of headaches down the road.

Next, make sure you’re up to date with all the latest tax laws and regulations. The CA CDTFA website is a great resource for staying informed. And if you’re ever in doubt, don’t hesitate to reach out to them for clarification. It’s better to ask questions now than face penalties later.

Common Compliance Pitfalls

Here are a few mistakes to avoid:

- Not filing on time

- Underreporting income

- Ignoring tax notices

Understanding Penalties

Let’s talk about the not-so-fun part of dealing with the CA CDTFA—penalties. If you fail to comply with tax laws, you could face fines, interest charges, and even legal action in severe cases. It’s like getting a speeding ticket, but way worse. The key is to avoid these penalties by staying informed and proactive.

And here’s a little secret: the CA CDTFA offers penalty relief programs for taxpayers who make honest mistakes. So, if you find yourself in a bind, don’t panic. Reach out to them and see if you qualify for relief. It’s like getting a second chance to make things right.

Resources for Taxpayers

The CA CDTFA offers a wealth of resources to help taxpayers stay informed and compliant. Their website is a treasure trove of information, with guides, FAQs, and interactive tools to make tax filing easier. They also host workshops and seminars throughout the year, which are great opportunities to learn from experts and network with other taxpayers.

And if you’re ever in doubt, don’t hesitate to contact their customer service team. They’re there to help, not to judge. It’s like having a personal assistant who’s always ready to lend a hand.

Future Changes to Watch For

As the world continues to evolve, so does the CA CDTFA. They’re constantly updating their systems, expanding their services, and adapting to new challenges. Keep an eye out for changes in tax laws, new technologies, and innovative programs that could affect you as a taxpayer.

And remember, staying informed is the key to success. Whether it’s through their website, social media, or newsletters, there are plenty of ways to stay up to date with the latest developments. It’s like having a front-row seat to the future of taxation in California.

Common Mistakes to Avoid

Alright, let’s wrap up with a few common mistakes to avoid when dealing with the CA CDTFA. First and foremost, don’t ignore their notices. Whether it’s a friendly reminder or a formal warning, it’s important to address any issues promptly. Ignoring them won’t make them go away—it’ll only make things worse.

Another big no-no is failing to file your taxes on time. Even if you can’t pay the full amount, it’s better to file and set up a payment plan than to miss the deadline altogether. And last but not least, don’t try to outsmart the system. The CA CDTFA has some pretty sophisticated tools for detecting fraud, so it’s not worth the risk.

Wrapping It All Up

Well, there you have it—a comprehensive guide to the CA CDTFA. From understanding their role to staying compliant and avoiding penalties, you now have the tools you need to navigate the world of California taxes with confidence. Remember, knowledge is power, and staying informed is the key to success.

So, what’s next? Take a moment to reflect on what you’ve learned and think about how you can apply it to your own situation. Whether it’s updating your records, reaching out to the CA CDTFA for clarification, or simply staying informed, every step you take brings you closer to financial peace of mind.

And don’t forget to share this article with your friends and family. The more people who understand the CA CDTFA, the better off we’ll all be. Together, we can make the world of taxes a little less intimidating and a lot more manageable. Cheers to that!

- Prince William And Lola A Royal Love Story You Wonrsquot Forget

- Sip Savor Your Ultimate Guide To Upscale Food Amp Wine Experiences

California CDTFA Third Party Access Security Code TaxJar Support

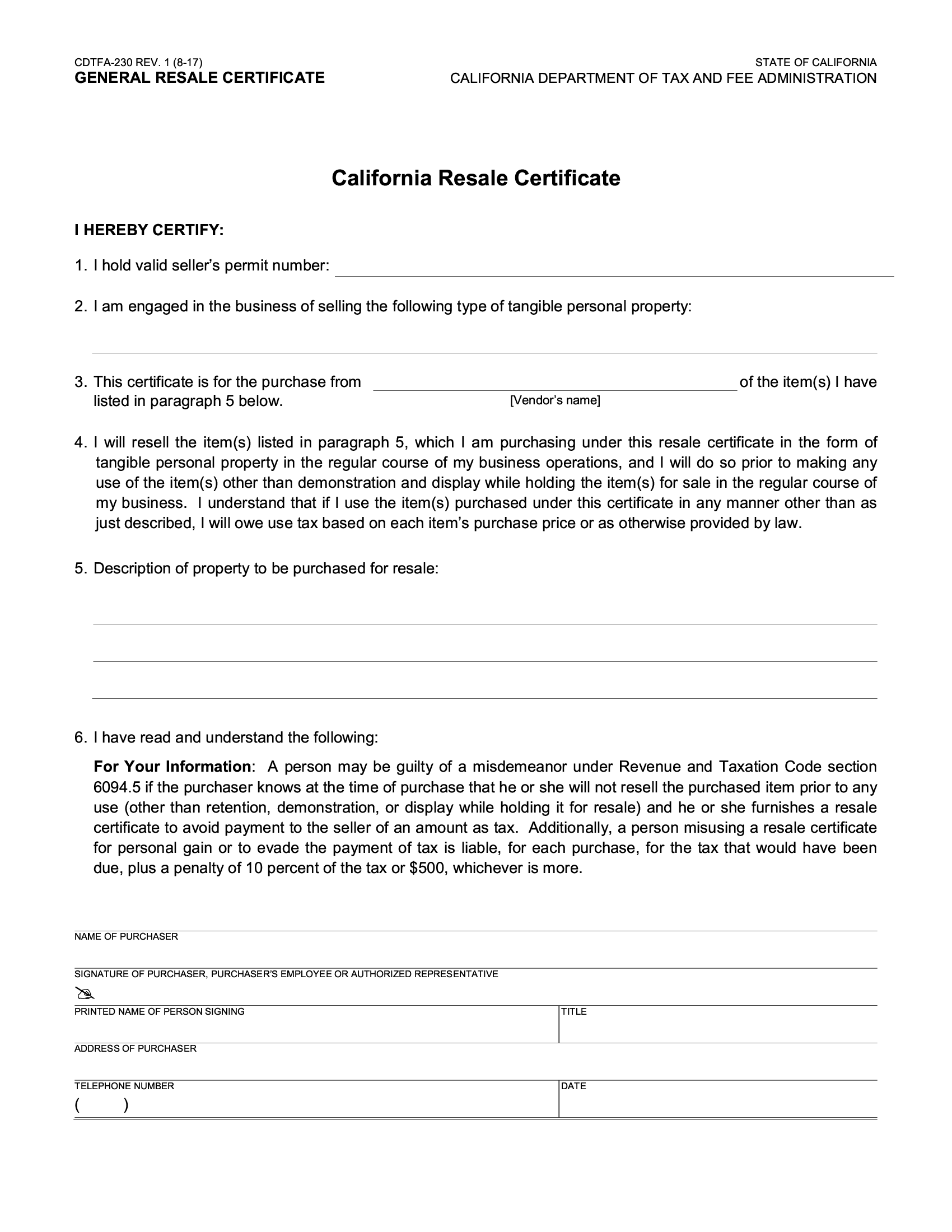

Form CDTFA230. General Resale Certificate (California) Forms Docs

How do I get a Exception board of Equalization CDT FA111 r/DMV