Progressive Insurance Refund: A Deep Dive Into Getting Your Money Back

Are you tired of dealing with insurance companies that make it harder for you to get refunds? Progressive Insurance, one of the biggest names in the industry, has been making waves with its policies and customer service. But what happens when you’re eligible for a refund? Is it as simple as calling customer support, or does it require more effort? Let’s break it down for you.

Getting a Progressive insurance refund might seem like a complicated process, but with the right information, it can be smoother than you think. Whether you’ve overpaid, canceled your policy, or simply want to understand your options, this guide will walk you through everything you need to know.

From understanding the terms and conditions to navigating the refund process, we’ve got you covered. So, buckle up because we’re about to dive deep into the world of Progressive Insurance refunds!

- How Tall Is Gagamaru Unveiling The Mystical Giants Height

- April 17 Zodiac Sign Discover The Traits And Secrets Of Your Star Sign

What is a Progressive Insurance Refund?

First things first, let’s clear up what exactly a Progressive Insurance refund is. In simple terms, it’s the money you get back from Progressive when you’ve paid more than you should have for your policy. This could happen for a variety of reasons, like policy cancellation, rate adjustments, or even errors on their end.

Progressive Insurance refunds aren’t just about getting your money back; they’re about ensuring fairness and transparency in your insurance dealings. The company prides itself on offering competitive rates, but sometimes, life happens, and refunds become necessary. Let’s explore why refunds occur in the first place.

Why Do Refunds Happen?

Here’s the deal: refunds happen for several reasons, and they’re not always because of mistakes. Sometimes, they’re part of the normal policy lifecycle. Here are some common scenarios:

- Black Bird In Angry Birds The Ultimate Guide To The Explosive Star

- Taylor Frankie Paul Tate A Rising Star In The Spotlight

- Policy Cancellation: If you cancel your policy before the end of the term, you’re usually entitled to a prorated refund for the unused portion.

- Rate Adjustments: Progressive might adjust your rates based on new information, like improved credit scores or changes in driving habits.

- Premium Errors: Mistakes happen, and if Progressive overcharges you, they’ll issue a refund.

- Policy Changes: If you modify your coverage or remove a vehicle from your policy, you might qualify for a refund.

Understanding these reasons is key to knowing whether you’re eligible for a refund. But how do you actually go about getting it? That’s where the process comes in.

How to Check If You’re Eligible for a Progressive Insurance Refund

Eligibility for a Progressive Insurance refund depends on your specific situation. To find out if you qualify, here’s what you need to do:

Start by reviewing your policy documents. Look for any changes you’ve made to your coverage, like removing a vehicle or reducing liability limits. If you’ve canceled your policy early, check the proration details in your contract. These documents will give you a clearer picture of your eligibility.

Next, log into your Progressive account. Their online portal often provides detailed information about your policy, including any pending refunds or adjustments. If you can’t find anything there, don’t worry—there’s still another step you can take.

Contacting Progressive Customer Support

Reaching out to Progressive’s customer service team is the most direct way to confirm your eligibility. They can review your account, answer your questions, and guide you through the refund process. Here’s how to contact them:

- Phone: Call their customer service hotline at 1-800-776-4737.

- Online Chat: Use the chat feature on their website for instant assistance.

- Email: Send an email through their contact form if you prefer written communication.

Remember, the more information you provide, the easier it will be for them to assist you. Have your policy number, account details, and any relevant documentation ready before you reach out.

The Progressive Insurance Refund Process

Once you’ve confirmed your eligibility, it’s time to start the refund process. Here’s what you can expect:

Progressive typically processes refunds within 7-10 business days after receiving your request. The exact timeline can vary depending on the complexity of your case and the method of refund you choose. Most refunds are issued via direct deposit or check, so make sure your banking information is up to date.

Steps to Request a Refund

Here’s a step-by-step guide to requesting your Progressive Insurance refund:

- Log into your Progressive account or call customer service.

- Provide your policy details and explain why you believe you’re owed a refund.

- Submit any required documentation, such as proof of policy cancellation or rate adjustment.

- Choose your preferred refund method (direct deposit or check).

- Wait for the refund to be processed and deposited into your account.

It’s important to follow these steps carefully to avoid delays. If you encounter any issues, don’t hesitate to follow up with Progressive’s support team.

Common Questions About Progressive Insurance Refunds

Let’s address some frequently asked questions about Progressive Insurance refunds:

Can You Get a Refund for Canceling Mid-Term?

Absolutely! If you cancel your policy mid-term, Progressive will refund the unused portion of your premium. However, they may charge a small cancellation fee, so be sure to check your policy terms for details.

How Long Does It Take to Get a Refund?

Most refunds are processed within 7-10 business days. However, this can vary based on the complexity of your case and the method of refund you choose. Direct deposits are usually faster than checks.

What Happens If There’s a Billing Error?

If Progressive overcharges you due to a billing error, they’ll issue a refund promptly. To ensure accuracy, always review your billing statements and report any discrepancies immediately.

Tips for Maximizing Your Progressive Insurance Refund

Want to make sure you get the most out of your Progressive Insurance refund? Here are a few tips:

- Review Your Policy Regularly: Keep an eye on your coverage and premiums to catch any potential issues early.

- Stay Organized: Keep all your policy documents and correspondence with Progressive in one place for easy reference.

- Communicate Clearly: When speaking with customer service, be specific about your request and provide all necessary details.

- Follow Up: If you don’t receive your refund within the expected timeframe, don’t hesitate to follow up with Progressive.

By staying proactive and informed, you can ensure a smoother refund experience.

Understanding Progressive’s Refund Policies

Progressive’s refund policies are designed to be fair and transparent, but they can vary depending on your policy type and location. Here’s a quick overview:

For auto insurance, refunds are typically prorated based on the number of days remaining in your policy term. Home insurance refunds follow a similar process, with adjustments for any claims paid during the policy period. Life insurance refunds, on the other hand, depend on the type of policy and any outstanding loans or withdrawals.

Key Factors That Affect Refunds

Several factors can influence the amount and timing of your refund:

- Policy Type: Different policies have different refund rules.

- Location: State regulations may impact how refunds are handled.

- Payment Method: Refunds issued via direct deposit are usually faster than checks.

- Policy History: Any claims or changes to your policy can affect your refund amount.

Understanding these factors can help you better anticipate your refund and plan accordingly.

Customer Reviews and Feedback

What do Progressive customers say about their refund experiences? Here’s a snapshot of some common feedback:

Many customers report positive experiences with Progressive’s refund process, praising the company’s responsiveness and efficiency. However, some have noted occasional delays or difficulties in getting through to customer service. Overall, the consensus is that Progressive strives to provide fair and timely refunds.

How to Leave a Review

If you’ve recently received a Progressive Insurance refund, consider sharing your experience. You can leave a review on their website, social media platforms, or third-party review sites like Trustpilot or Yelp. Your feedback can help others navigate the process and improve Progressive’s services.

Conclusion: Take Control of Your Progressive Insurance Refund

In conclusion, getting a Progressive Insurance refund doesn’t have to be a headache. By understanding the reasons for refunds, confirming your eligibility, and following the proper steps, you can ensure a smooth and hassle-free process.

Remember, if you encounter any issues or have questions, don’t hesitate to reach out to Progressive’s customer service team. They’re there to help you every step of the way.

So, what are you waiting for? Take control of your refund today and get the money you deserve. And while you’re at it, why not share this article with your friends and family? Who knows, you might just help someone else navigate the refund process too!

Table of Contents

- What is a Progressive Insurance Refund?

- Why Do Refunds Happen?

- How to Check If You’re Eligible for a Progressive Insurance Refund

- Contacting Progressive Customer Support

- The Progressive Insurance Refund Process

- Steps to Request a Refund

- Common Questions About Progressive Insurance Refunds

- Tips for Maximizing Your Progressive Insurance Refund

- Understanding Progressive’s Refund Policies

- Customer Reviews and Feedback

- How to Leave a Review

How To Cancel Your Insurance Policy Bjak.my

Effective Ways To Cancel Progressive Insurance A Stepbystep Guide How

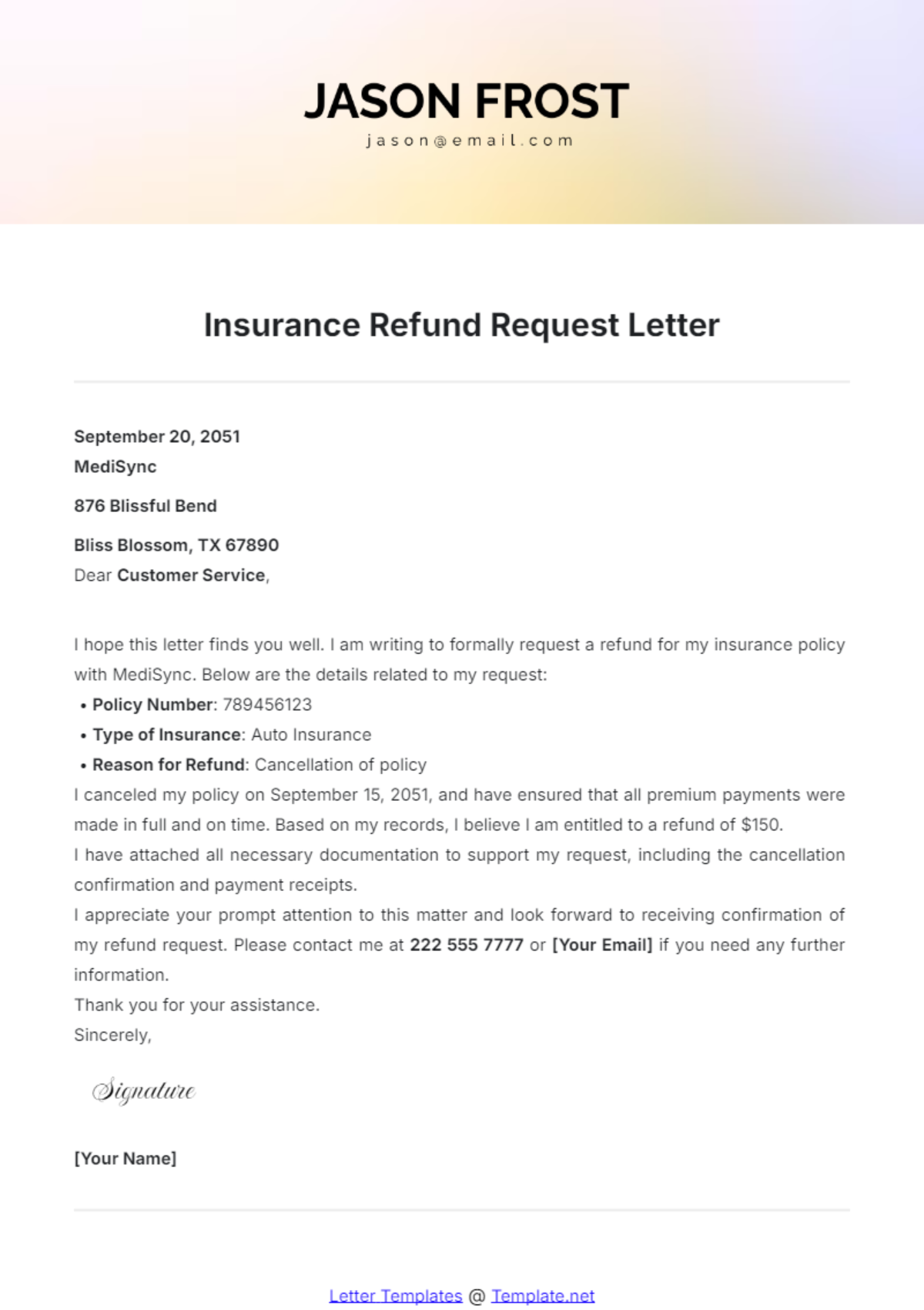

Free Insurance Refund Request Letter Template to Edit Online