State Farm Collision Deductible: Your Ultimate Guide To Understanding And Saving

Let’s face it—car accidents happen, and when they do, your wallet might take a hit. But here’s the good news: understanding your State Farm collision deductible can save you big bucks down the line. Whether you’re a new driver or a seasoned road warrior, knowing how deductibles work is key to managing your finances after an accident. In this article, we’ll break it all down for you in plain English so you can make smarter decisions.

Picture this—you’re cruising along, minding your own business, when suddenly—bam! A fender bender. Now, you’re staring at repair bills, wondering how much of that cost you’ll have to foot yourself. That’s where your State Farm collision deductible comes into play. It’s like the fine print in your insurance policy that determines how much you pay out-of-pocket before your coverage kicks in.

But don’t worry, we’re here to demystify the whole process. By the end of this article, you’ll know exactly what a collision deductible is, how it works, and how to choose the right one for your budget. So, grab a coffee, get comfy, and let’s dive in!

- Discover The Best Funeral Homes In Jasper Georgia For Your Needs

- Unclaimed Money In California A Hidden Treasure Awaits

What Exactly Is a State Farm Collision Deductible?

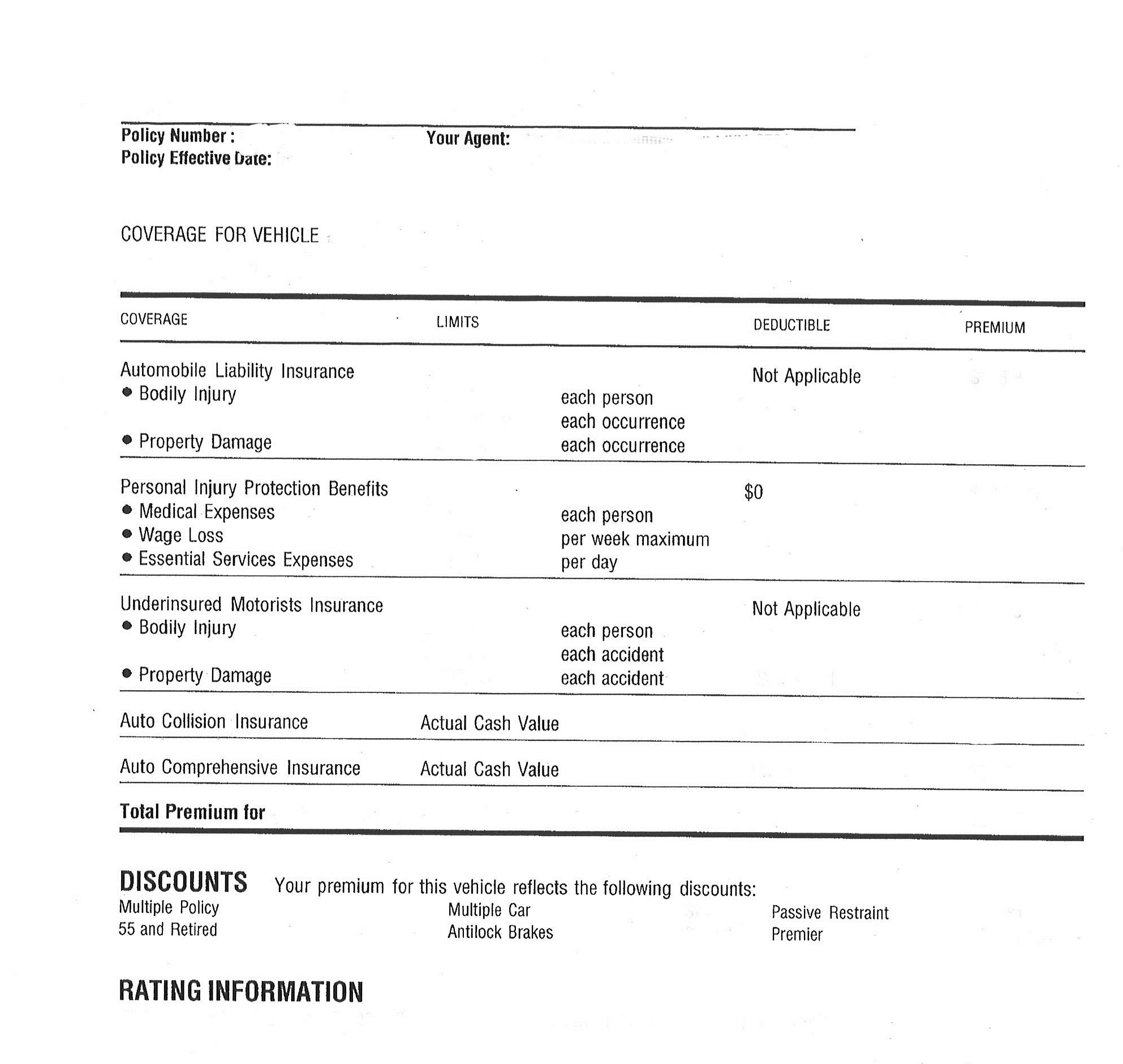

Alright, let’s start with the basics. A State Farm collision deductible is the amount you agree to pay out-of-pocket when you file a claim for damage to your vehicle after an accident. Think of it as your “skin in the game” before State Farm steps in to cover the rest of the repair costs.

For example, if your deductible is $500 and the repairs cost $3,000, you’ll pay the first $500, and State Farm will cover the remaining $2,500. Simple, right? Well, not always. There’s a lot more to consider, like choosing the right deductible amount and understanding how it affects your premium.

Here’s a quick rundown of why your collision deductible matters:

- Enrons Ceo Unveiling The Rise And Fall Of A Corporate Titan

- Did Stevan And Alara Break Up The Inside Scoop Yoursquove Been Waiting For

- It directly impacts how much you pay upfront after an accident.

- A higher deductible usually means lower monthly premiums, but you’ll pay more out-of-pocket if you need to file a claim.

- A lower deductible means higher premiums, but you’ll pay less out-of-pocket in the event of an accident.

How Does a Collision Deductible Work?

Now that we’ve got the definition out of the way, let’s talk about how it actually works. When you purchase collision coverage from State Farm, you’ll select a deductible amount. This amount is subtracted from the total repair costs when you file a claim.

Let’s break it down with an example. Say your car gets totaled in an accident, and the estimated value of your vehicle is $10,000. If your deductible is $1,000, State Farm will cut you a check for $9,000 after you pay your $1,000 share. Makes sense?

But here’s the thing—deductibles aren’t one-size-fits-all. Your choice of deductible depends on your financial situation, driving habits, and risk tolerance. We’ll dive deeper into that later, but for now, just remember that your deductible is a critical part of your insurance policy.

Key Factors That Influence Your Deductible

So, what determines how much your collision deductible will be? Here are a few factors to consider:

- Your Financial Situation: Can you afford a higher deductible if you get into an accident? If not, you might want to go with a lower one.

- Your Driving Record: If you have a clean record, you might feel comfortable choosing a higher deductible since the odds of an accident are lower.

- The Value of Your Vehicle: If you’re driving a luxury car, a higher deductible might make more sense to keep your premiums down.

Why Is Choosing the Right Deductible Important?

Choosing the right collision deductible is like finding the perfect pair of jeans—it’s all about balance. If you pick a deductible that’s too high, you might struggle to pay it if you get into an accident. On the other hand, if your deductible is too low, you could end up paying more in premiums over time.

Here’s the deal: a higher deductible lowers your monthly premiums because you’re taking on more financial responsibility. But if you get into an accident, you’ll need to cough up that higher amount upfront. Conversely, a lower deductible means higher premiums, but you’ll pay less out-of-pocket if you file a claim.

So, how do you strike the right balance? Let’s explore some strategies in the next section.

Tips for Choosing the Right Deductible

Here are a few tips to help you decide:

- Assess Your Savings: Do you have enough in your emergency fund to cover a higher deductible? If not, consider going with a lower one.

- Evaluate Your Driving Habits: If you drive a lot or in high-risk areas, a lower deductible might be safer.

- Consider Your Vehicle’s Value: If your car is older and worth less, a higher deductible might not make sense.

State Farm Collision Deductible vs. Other Insurers

When it comes to collision deductibles, State Farm isn’t the only game in town. Most major insurance companies offer similar options, but there are a few key differences to keep in mind.

For starters, State Farm offers a wide range of deductible options, typically ranging from $100 to $2,000. Other insurers might offer different minimums or maximums, so it’s worth shopping around to find the best fit for your needs.

Additionally, State Farm often provides discounts and perks that other insurers might not. For example, if you’ve been accident-free for a certain period, you might qualify for a deductible reduction. Pretty sweet, right?

Comparing Deductibles Across Insurers

Here’s a quick comparison of collision deductibles from some top insurers:

- State Farm: $100 to $2,000

- Geico: $100 to $1,000

- Progressive: $250 to $1,000

- Allstate: $100 to $2,000

As you can see, State Farm offers a bit more flexibility when it comes to deductible amounts. But remember, the best choice depends on your personal circumstances.

How Much Should You Pay for a Collision Deductible?

This is the million-dollar question, isn’t it? The truth is, there’s no one-size-fits-all answer. It all comes down to your financial situation and risk tolerance. But here’s a general guideline:

If you’re on a tight budget, a lower deductible (around $250 to $500) might be the way to go. This will give you more breathing room if you get into an accident, but it’ll mean higher premiums in the long run.

On the flip side, if you have a solid emergency fund and can afford a higher deductible (around $1,000 or more), you’ll enjoy lower monthly premiums. Just make sure you’re comfortable with the upfront cost if you ever need to file a claim.

Real-Life Examples

Let’s look at a couple of scenarios to illustrate this point:

- Scenario 1: Sarah is a young driver with a part-time job and limited savings. She opts for a $250 deductible to keep her out-of-pocket costs manageable.

- Scenario 2: John is a seasoned driver with a high-paying job and a robust emergency fund. He chooses a $1,000 deductible to keep his premiums low.

See the difference? Your choice of deductible should reflect your unique situation.

State Farm Collision Deductible Waiver

Did you know that State Farm offers a collision deductible waiver under certain conditions? It’s like insurance for your insurance. If you’re involved in an accident that’s not your fault, State Farm will waive your deductible, meaning you won’t have to pay anything out-of-pocket.

This is a pretty sweet deal, especially if you’re worried about footing the bill after a not-at-fault accident. But there are some caveats to keep in mind. For example, the waiver typically only applies if the other driver’s insurance covers the damages. So, it’s not a guaranteed safety net, but it’s definitely worth considering.

When Does the Deductible Waiver Apply?

Here’s when the collision deductible waiver kicks in:

- Not-At-Fault Accidents: If the other driver is deemed at fault, State Farm will waive your deductible.

- Uninsured Motorist Coverage: If the other driver doesn’t have insurance, your waiver might still apply, depending on your policy.

- Hit-and-Run Situations: In some cases, the waiver can cover hit-and-run accidents, but check your policy for details.

Common Myths About State Farm Collision Deductibles

There’s a lot of misinformation floating around about collision deductibles, so let’s bust some myths:

- Myth #1: A higher deductible always saves money. Fact: While a higher deductible lowers your premiums, it also increases your out-of-pocket costs after an accident.

- Myth #2: Deductibles don’t matter if you have full coverage. Fact: Collision coverage is part of full coverage, and your deductible still applies.

- Myth #3: Deductibles only apply to repairs. Fact: Deductibles also apply to total losses, so they can have a big impact on your payout.

Why Knowing the Truth Matters

Understanding the facts about collision deductibles can help you make smarter decisions about your insurance. Don’t fall for these myths—do your research and ask your agent if you’re unsure.

State Farm Collision Deductible FAQs

Still have questions? Here are some common ones we get about State Farm collision deductibles:

Q: Can I Change My Deductible?

A: Absolutely! You can change your deductible at any time by contacting your State Farm agent. Just keep in mind that changing your deductible might affect your premium.

Q: What Happens If I Can’t Pay My Deductible?

A: If you can’t pay your deductible, your claim might be delayed or denied. That’s why it’s important to choose a deductible you can comfortably afford.

Q: Does My Deductible Affect My Credit Score?

A: No, your collision deductible doesn’t directly affect your credit score. However, if you finance your premium payments and miss a payment, that could impact your credit.

Conclusion

And there you have it—the lowdown on State Farm collision deductibles. By now, you should have a solid understanding of what a deductible is, how it works, and how to choose the right one for your needs.

Remember, your collision deductible is just one piece of the insurance puzzle. Make sure you review your entire policy regularly to ensure you’re getting the best coverage at the best price.

So, what’s next? Take action! Review your current policy, talk to your State Farm agent, and make any necessary changes to your deductible. And don’t forget to share this article with your friends and family so they can get savvy about their insurance too!

Table of Contents

- What Exactly Is a State Farm Collision Deductible?

- How Does a Collision Deductible Work?

- Why Is Choosing the Right Deductible Important?

- State Farm Collision Deductible vs. Other Insurers

- How Much Should You Pay for a Collision Deductible?

- State Farm Collision Deductible Waiver

- Common Myths About State Farm Collision Deductibles

- State Farm Collision Deductible FAQs

- Lil Kim Before Surgery The Untold Journey Of A Hiphop Icon

- Spurs 2025 Roster The Future Of Tottenham Hotspur In The Making

state farm auto policy booklet

State Farm Increases Deductible Editorial Photo Image of agencies

New State Farm® data reveals the likelihood of hitting an animal while