Fidelity Savings Plan: Your Ultimate Guide To Building A Secure Financial Future

Imagine this: You're sitting in your cozy living room, scrolling through social media, and suddenly you see a post from a friend talking about how they just bought their dream home or took an amazing vacation. You start wondering, "How do they afford all this?" Well, my friend, the secret might just lie in something called a Fidelity Savings Plan. Let's dive into what it is, why it matters, and how you can harness its power to create the financial stability you've always dreamed of.

Nowadays, saving isn't just about stashing cash under your mattress or keeping it in a low-interest bank account. People are getting smarter with their money, and tools like the Fidelity Savings Plan are becoming increasingly popular. It's not rocket science, but it does require a bit of understanding to make the most out of it. Stick around, and we'll break it down step by step.

Whether you're a young professional looking to kickstart your savings journey or someone nearing retirement who wants to secure their golden years, the Fidelity Savings Plan could be your golden ticket. Let's explore why it's worth considering and how it can transform your financial landscape.

- The Burgesses A Comprehensive Dive Into Their History Influence And Legacy

- Az Corporations Search Your Ultimate Guide To Uncovering Hidden Business Opportunities

What Exactly is a Fidelity Savings Plan?

Alright, let's get real here. A Fidelity Savings Plan is essentially a structured way to save and invest your money with the goal of growing it over time. It’s more than just saving—it’s about leveraging the power of compound interest and smart investment strategies. Think of it like planting a tree; you nurture it today, and years down the line, it bears fruit that can sustain you.

Here’s the deal: With a Fidelity Savings Plan, you’re not just parking your money somewhere safe. You’re actively participating in the market, whether it’s through stocks, bonds, or mutual funds. The beauty of it is that you can customize your plan based on your risk tolerance, financial goals, and time horizon. And guess what? It’s super flexible, so you can adjust it as your life changes.

Key Features of the Fidelity Savings Plan

- Automatic Contributions: Set it and forget it! You can schedule regular contributions to your plan, ensuring consistency in your savings.

- Diversification: Don’t put all your eggs in one basket. The plan allows you to spread your investments across different asset classes, reducing risk.

- Professional Management: If you’re not a finance whiz, no worries. Fidelity has experts who manage your portfolio, ensuring it aligns with your goals.

- Low Minimum Investments: You don’t need a fortune to start. Even small contributions can add up over time.

Why Should You Consider a Fidelity Savings Plan?

In today’s world, financial security is more important than ever. Between rising costs of living, inflation, and unpredictable economic conditions, having a solid savings plan is crucial. A Fidelity Savings Plan offers several advantages that make it an attractive option for anyone looking to build wealth.

- July 14 Zodiac Discover The Mystical Traits Of Cancer And The Cosmic Dance

- Peoria Illinois Busted Newspaper The Inside Scoop You Need To Know

For starters, it provides access to a wide range of investment opportunities that might otherwise be out of reach. Plus, the convenience of automated contributions means you’re less likely to fall off track. And let’s not forget the potential for growth—your money could work harder for you than it would sitting in a regular savings account.

Benefits at a Glance

- Growth Potential: By investing in the market, you have the chance to earn higher returns compared to traditional savings accounts.

- Flexibility: You can tweak your contributions, change your investment mix, or even pause contributions if needed.

- Peace of Mind: Knowing that you’re actively working towards your financial goals can reduce stress and anxiety about the future.

How Does a Fidelity Savings Plan Work?

Let’s break it down into simple terms. When you sign up for a Fidelity Savings Plan, you’ll first need to decide how much you want to contribute regularly—whether it’s weekly, bi-weekly, or monthly. Then, you’ll choose where you want your money to be invested. Fidelity offers a variety of options, from conservative to aggressive, depending on your comfort level with risk.

Once everything is set up, your contributions will automatically be invested according to your chosen strategy. Over time, as the market fluctuates, your investments will hopefully grow, providing you with a solid nest egg for the future. It’s a bit like playing the long game in life—you’re planning for tomorrow while living in the present.

Step-by-Step Guide to Getting Started

- Open an account with Fidelity.

- Determine your contribution amount and frequency.

- Select your investment options based on your goals and risk tolerance.

- Set up automatic contributions to keep things consistent.

- Monitor your progress and make adjustments as needed.

Who is a Fidelity Savings Plan Ideal For?

Here’s the thing: A Fidelity Savings Plan isn’t a one-size-fits-all solution. It’s best suited for people who are serious about growing their wealth and are willing to take on some level of risk. If you’re the type of person who prefers guaranteed returns, this might not be the right fit for you. However, if you’re okay with riding the ups and downs of the market, it could be a game-changer.

It’s also perfect for those who want a hands-off approach to investing. With professional management and automated contributions, you can focus on other aspects of your life while your money works for you in the background. Plus, it’s a great option for anyone looking to build long-term wealth, whether it’s for retirement, buying a home, or funding a dream vacation.

Is It Right for You?

- Are you comfortable with market fluctuations?

- Do you have a clear financial goal in mind?

- Can you commit to regular contributions?

- Are you looking for growth potential rather than guaranteed returns?

Common Misconceptions About Fidelity Savings Plans

There are a few myths floating around about Fidelity Savings Plans that we need to clear up. Some people think it’s only for the wealthy, but that couldn’t be further from the truth. Anyone can benefit from a Fidelity Savings Plan, regardless of their income level. Another misconception is that it’s too complicated, but with the right guidance and tools, it’s actually quite straightforward.

Additionally, some folks worry about locking their money away for years. While it’s true that certain investments may have restrictions, many Fidelity Savings Plans offer liquidity, meaning you can access your funds when you need them. It’s all about finding the right balance between growth and accessibility.

Debunking the Myths

- It’s not just for the rich—anyone can participate.

- It’s not overly complex—there are resources to help you understand it.

- You don’t have to sacrifice liquidity—many plans offer flexible options.

How to Maximize Your Fidelity Savings Plan

Now that you know the basics, let’s talk about how you can get the most out of your Fidelity Savings Plan. First and foremost, consistency is key. Regular contributions, no matter how small, can add up significantly over time thanks to compound interest. Think of it like watering a plant every day—it may not seem like much at first, but eventually, it blossoms into something beautiful.

Another tip is to periodically review your investment strategy. As your life changes, so should your financial goals. Maybe you started the plan to save for a house, but now you’re thinking about retirement. Adjusting your portfolio to match your evolving needs can help you stay on track.

Tips for Success

- Stay consistent with your contributions.

- Review and adjust your investment strategy regularly.

- Take advantage of any employer-matching programs if available.

- Stay informed about market trends and economic conditions.

Real-Life Success Stories

Let’s hear from some real people who have benefited from Fidelity Savings Plans. Sarah, a 30-year-old marketing specialist, started her plan five years ago with a modest monthly contribution. Today, her account has grown significantly, and she’s well on her way to achieving her dream of early retirement. Meanwhile, John, a 45-year-old engineer, used his plan to save for his children’s college education, ensuring they wouldn’t have to worry about student loans.

These stories show that a Fidelity Savings Plan can be tailored to meet a variety of needs and goals. Whether you’re starting out or looking to secure your later years, there’s a plan that can work for you.

Lessons Learned from Success Stories

- Start early to maximize growth potential.

- Set clear goals and stick to them.

- Be patient—results take time, but they’re worth it.

Conclusion: Take Control of Your Financial Future

So there you have it—the lowdown on Fidelity Savings Plans. Whether you’re looking to build long-term wealth, save for a specific goal, or simply gain peace of mind about your financial future, this plan could be the tool you need. Remember, the key is consistency, flexibility, and staying informed.

Now it’s your turn. Are you ready to take the first step towards securing your financial future? Leave a comment below and let us know what excites you most about starting a Fidelity Savings Plan. And don’t forget to share this article with friends and family who might benefit from the information. Together, we can all work towards a brighter, more stable tomorrow!

Table of Contents

What Exactly is a Fidelity Savings Plan?

Why Should You Consider a Fidelity Savings Plan?

How Does a Fidelity Savings Plan Work?

Who is a Fidelity Savings Plan Ideal For?

Common Misconceptions About Fidelity Savings Plans

How to Maximize Your Fidelity Savings Plan

Conclusion: Take Control of Your Financial Future

- Unlock Your Travel Adventures With Atl Map Airport

- Bad Traits Of Aquarius The Hidden Side Of The Water Bearer You Need To Know

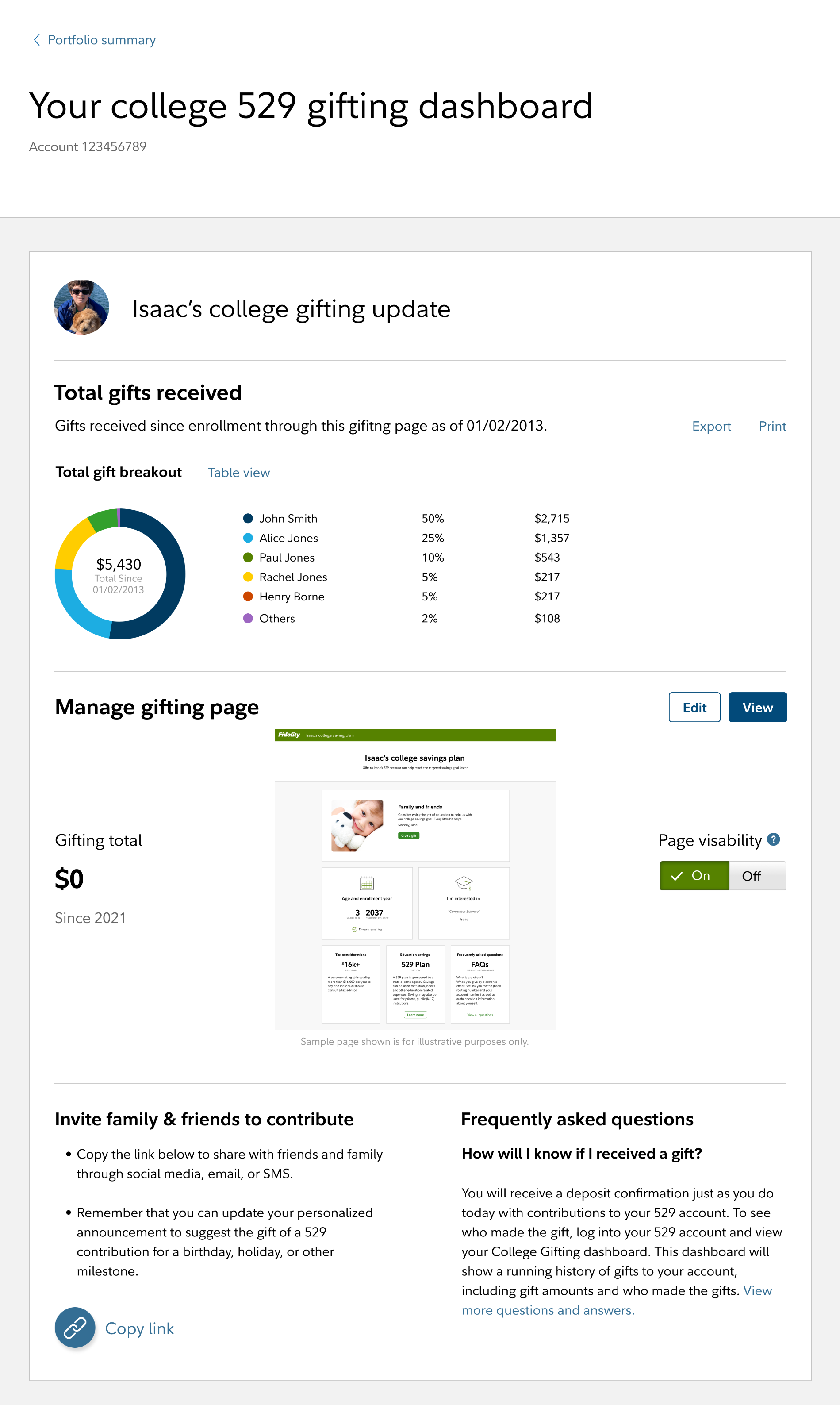

College Gifting Program 529 Savings Plan Fidelity

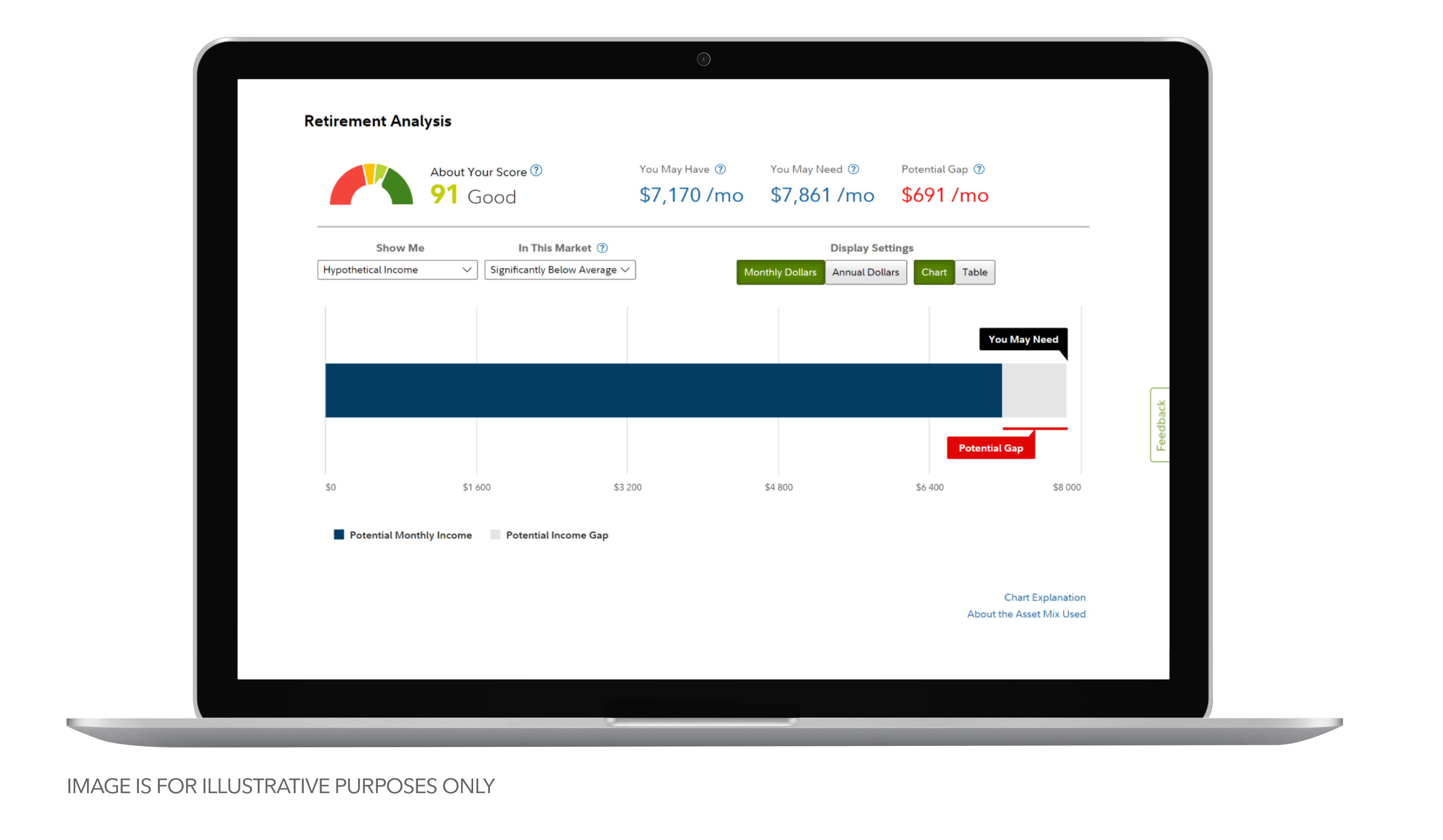

Retirement Annuities Annuity Solutions to Consider Fidelity

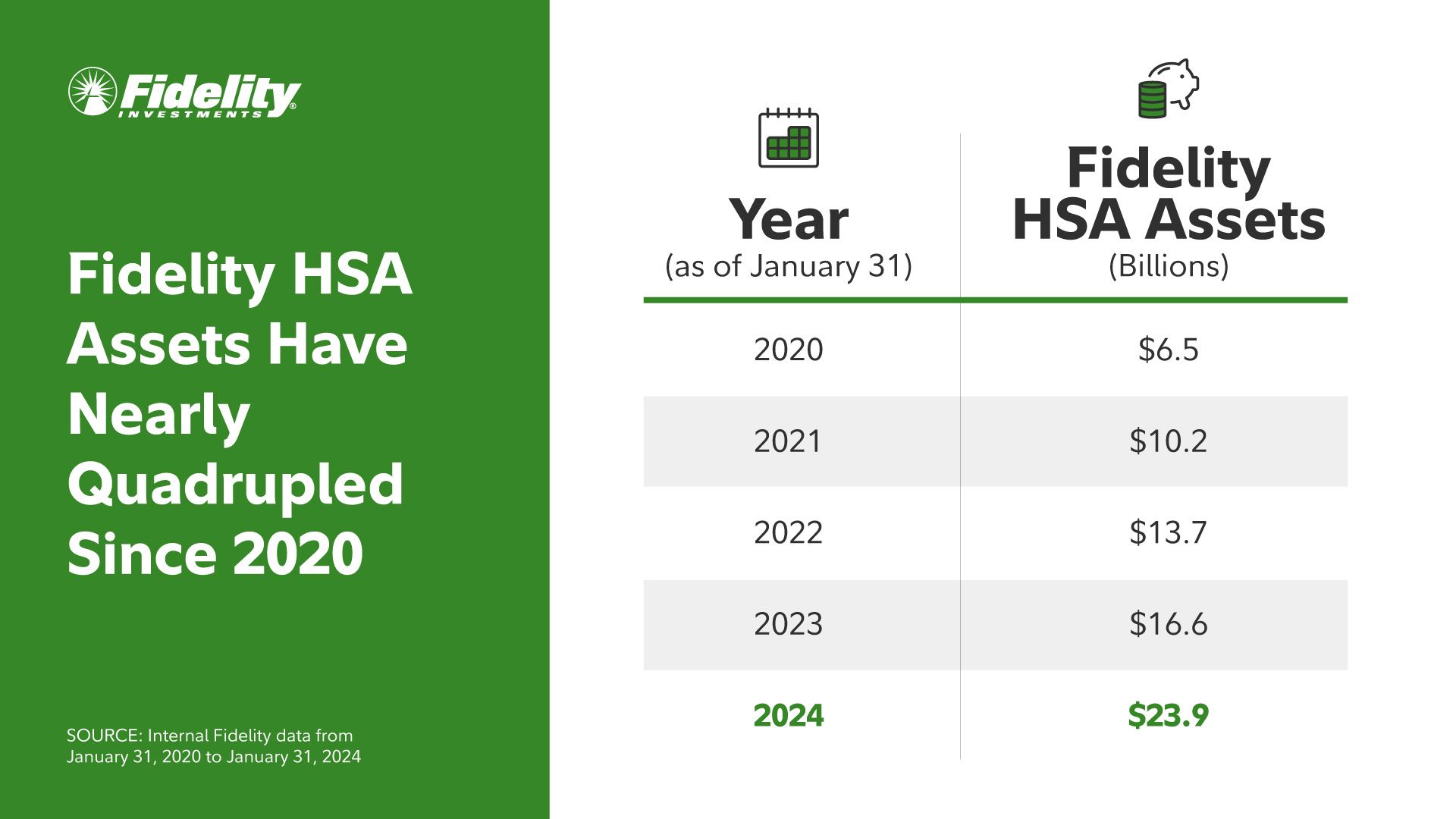

Fidelity Health® Report Total Assets in Fidelity Health Savings