Arizona Business Entity: Your Ultimate Guide To Success In The Grand Canyon State

Let's talk about Arizona business entity, folks. If you're thinking about starting a business in Arizona, you're in the right place. The state is booming with opportunities, and understanding the ins and outs of business entities is crucial for your success. Whether you're a first-time entrepreneur or a seasoned pro, this guide will help you navigate the world of Arizona business entities like a champ.

Arizona has always been a hotspot for entrepreneurs, offering a vibrant economy and a friendly business climate. But before you dive headfirst into the business world, you need to know your options. Choosing the right business entity is one of the most important decisions you'll make, and it can affect everything from taxes to liability. So, buckle up, and let's break it down for ya.

There's a lot to cover, but don't worry. We'll walk you through the basics, the benefits, and the legal stuff you need to know. By the end of this guide, you'll feel confident in making the right choice for your business. Let's get started!

- Ou Football Stadium The Heart Of Sooner Nation

- Top Restaurants At Mdw A Foodies Ultimate Guide To Midway Airport Dining

Why Arizona Business Entity Matters

First things first, why does your choice of business entity matter so much? Well, think of it like picking the right car for a road trip. You wouldn't choose a compact car for a cross-country adventure, right? Similarly, choosing the wrong business entity can lead to unnecessary complications down the road.

Here's the deal: your business entity determines how your company is structured, taxed, and protected under the law. For instance, if you choose a sole proprietorship, you might face unlimited liability. But if you opt for an LLC or corporation, you could shield your personal assets from business debts. It's all about finding the right fit for your business goals.

And guess what? Arizona makes it easy to register your business entity with user-friendly processes and resources. Plus, the state offers a supportive environment for startups and small businesses, which is a big plus if you're just starting out.

- The Office Cst A Comprehensive Dive Into The Cult Classic

- County Sheriff The Unsung Heroes Of Our Communities

Types of Arizona Business Entities

Now that we've covered why it matters, let's dive into the different types of business entities you can choose from in Arizona. Each option has its pros and cons, so it's essential to weigh them carefully.

Sole Proprietorship

A sole proprietorship is the simplest and most common type of business entity. It's perfect for freelancers, consultants, or anyone who wants to start a business on their own. The good news is that it's easy to set up and requires minimal paperwork. However, as we mentioned earlier, you're personally liable for all business debts.

Partnership

If you're teaming up with someone else, a partnership might be the way to go. There are two main types: general partnerships and limited partnerships. In a general partnership, all partners share liability, while in a limited partnership, some partners have limited liability. It's like having a business buddy, but you gotta be careful about the legal stuff.

LLC (Limited Liability Company)

LLCs are becoming increasingly popular among small business owners in Arizona. They offer the best of both worlds: the liability protection of a corporation and the tax benefits of a partnership. Plus, you get to enjoy the flexibility of managing your business however you see fit. It's like having your cake and eating it too!

Corporation

For those looking to take their business to the next level, a corporation might be the way to go. Corporations offer the highest level of liability protection and can issue stock to raise capital. However, they come with more paperwork and regulatory requirements. It's like running a Fortune 500 company, but on a smaller scale.

How to Choose the Right Business Entity

Choosing the right business entity is all about aligning it with your goals. Here are a few questions to ask yourself:

- What's the size of my business?

- How much liability protection do I need?

- What are my long-term plans for the business?

- Do I want to raise capital through investors?

Once you've answered these questions, you'll have a better idea of which entity suits your needs. Don't be afraid to consult with a lawyer or accountant if you're unsure. After all, it's better to be safe than sorry.

Arizona Business Entity Registration Process

Alright, so you've decided on your business entity. Now, let's talk about how to register it in Arizona. The process is straightforward, but there are a few steps you need to follow:

1. Choose a Business Name

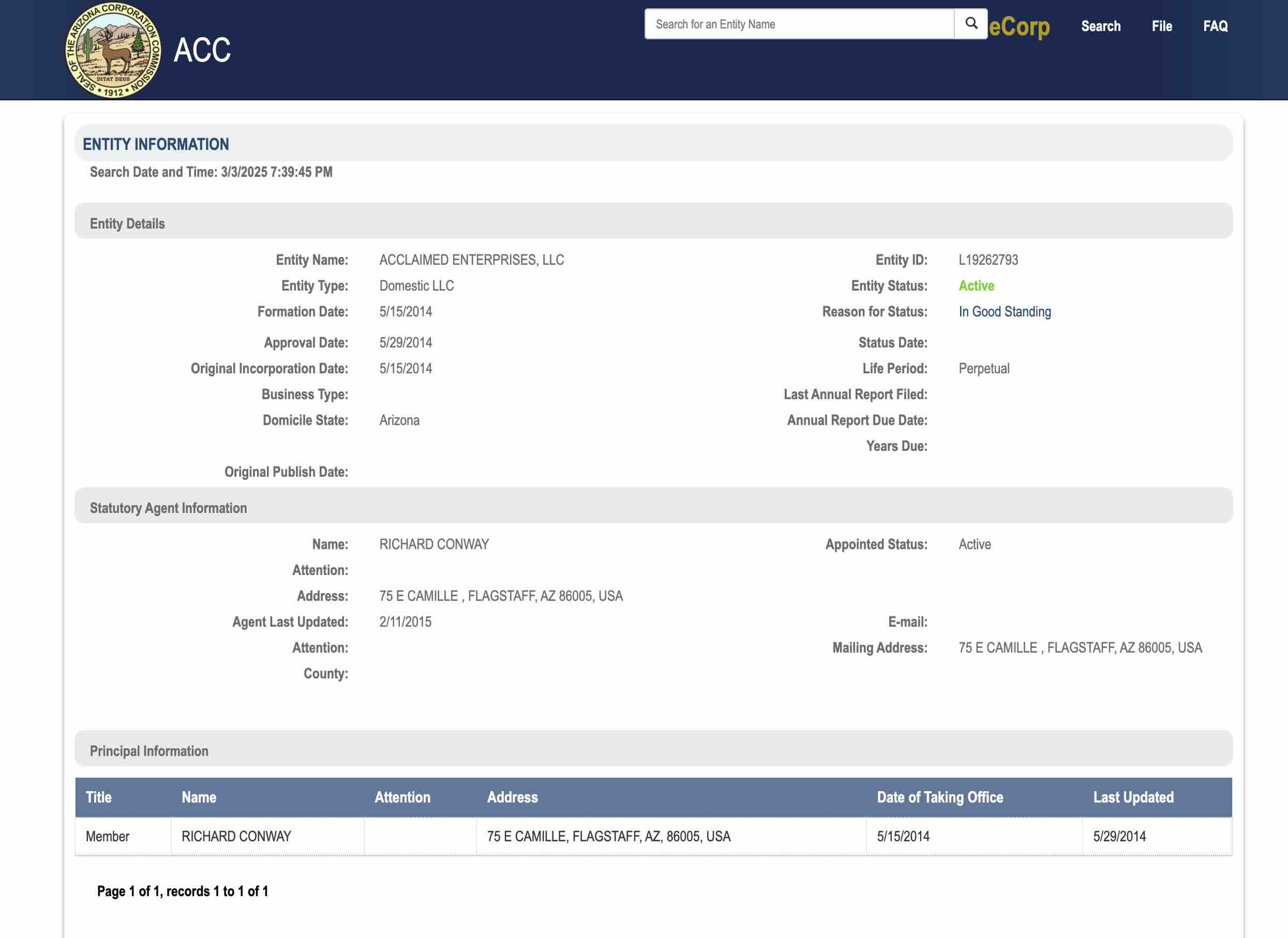

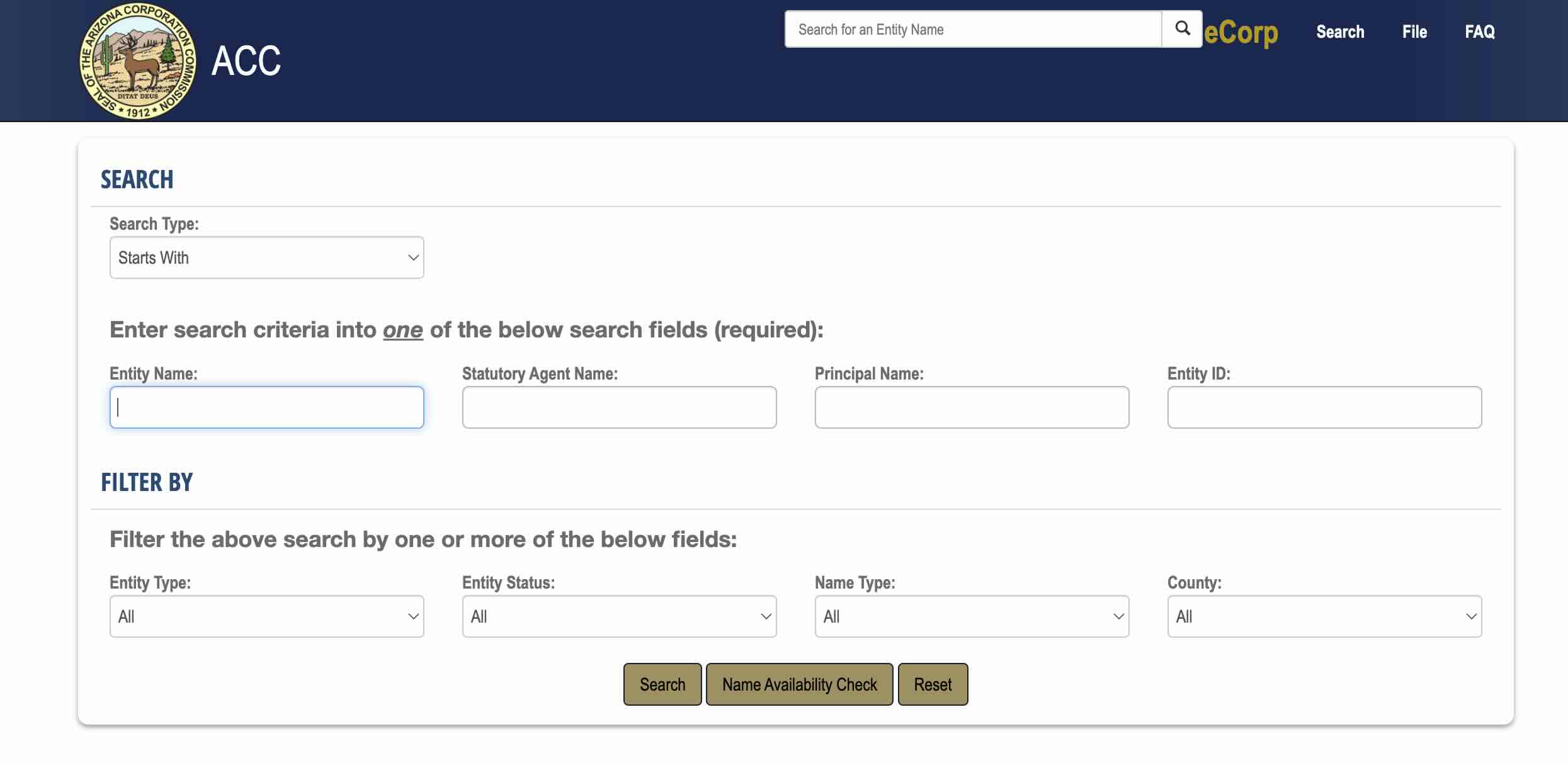

Pick a name that reflects your brand and is unique. You can check the availability of your desired name through the Arizona Corporation Commission's website. Trust me, you don't want to get stuck with a name that's already taken.

2. File the Necessary Forms

Depending on your entity type, you'll need to file specific forms. For example, LLCs need to file Articles of Organization, while corporations need to file Articles of Incorporation. You can do this online or by mail, but online filing is usually faster.

3. Obtain an EIN

An Employer Identification Number (EIN) is like a Social Security number for your business. You'll need it for tax purposes and to open a business bank account. You can apply for an EIN through the IRS website. It's a quick and easy process, so don't stress about it.

Taxes and Arizona Business Entity

Taxes can be a headache, but understanding how they apply to your business entity can save you a lot of trouble. Here's a quick breakdown:

- Sole Proprietorships: Taxes are reported on your personal tax return.

- Partnerships: Taxes are reported on the business's tax return, but partners pay taxes individually.

- LLCs: Taxes depend on how the LLC is structured, but they're usually pass-through entities.

- Corporations: Corporations pay taxes on their profits, and shareholders pay taxes on dividends.

It's always a good idea to consult with a tax professional to ensure you're meeting all requirements. Nobody likes a surprise audit, right?

Liability Protection and Arizona Business Entity

Liability protection is a big deal, especially if you're running a business in Arizona. Depending on your entity type, you might be personally liable for business debts. This means that if your business goes belly up, your personal assets could be at risk.

That's where LLCs and corporations come in handy. They offer limited liability protection, which means your personal assets are shielded from business debts. It's like having a safety net in case things go south.

Arizona Business Entity and Financing

If you're looking to raise capital for your business, your entity type can affect your options. For instance, corporations can issue stock to attract investors, while LLCs can offer membership units. It's all about finding the right financing strategy for your business.

Keep in mind that raising capital comes with its own set of rules and regulations. You'll need to comply with Arizona's securities laws, which can be a bit tricky. Again, consulting with a lawyer or accountant can save you a lot of headaches.

Common Mistakes to Avoid

Starting a business is exciting, but it's easy to make mistakes along the way. Here are a few common ones to watch out for:

- Choosing the wrong business entity

- Not registering your business properly

- Ignoring liability protection

- Not keeping personal and business finances separate

By avoiding these mistakes, you'll set yourself up for success from the get-go. It's like avoiding potholes on a road trip; you'll have a smoother ride.

Conclusion

Choosing the right Arizona business entity is crucial for your success as an entrepreneur. Whether you opt for a sole proprietorship, partnership, LLC, or corporation, each option has its own set of benefits and challenges. By doing your research and consulting with professionals, you can make an informed decision that aligns with your business goals.

So, what are you waiting for? Take the first step towards turning your business dreams into reality. And don't forget to share this article with your fellow entrepreneurs. The more, the merrier, right?

Table of Contents:

- Arizona Business Entity: Your Ultimate Guide to Success in the Grand Canyon State

- Why Arizona Business Entity Matters

- Types of Arizona Business Entities

- How to Choose the Right Business Entity

- Arizona Business Entity Registration Process

- Taxes and Arizona Business Entity

- Liability Protection and Arizona Business Entity

- Arizona Business Entity and Financing

- Common Mistakes to Avoid

- Conclusion

- Michelle Yeohs Young The Untold Story Of A Hollywood Legends Early Life

- Who Makes Mini Cooper The Inside Scoop On The Iconic Car Brand

Arizona Business Entity Search and Choosing your LLC name

Conduct an Arizona Business Entity Search (SOS) BrandSnag

Conduct an Arizona Business Entity Search (SOS) BrandSnag