What Is A Billing Address? Your Ultimate Guide To Understanding And Using It

Ever wondered what exactly a billing address is and why it’s such a big deal when you’re shopping online or signing up for services? Well, buckle up, because we’re about to dive deep into the world of billing addresses, and trust me, by the end of this article, you’ll be an expert. Whether you’re a newbie to online shopping or just trying to figure out why your transactions keep getting flagged, understanding what a billing address is can save you a ton of hassle. So, let’s break it down in simple terms, shall we?

A billing address is more than just a line on your payment form. It’s the key to verifying your identity and ensuring that your transactions are legit. Think of it as the digital fingerprint that links you to your purchases. Without it, things can get messy real quick. In this article, we’ll explore everything you need to know about billing addresses, from what they are to how they work and why they matter.

But before we get into the nitty-gritty, let’s clear up one thing: your billing address doesn’t always have to match your shipping address. Confusing, right? Don’t worry—we’ll explain all of that in just a bit. For now, just remember that understanding your billing address can help you avoid those pesky declined transactions and make your online shopping experience smoother than ever.

- Who Wins Holiday Baking Championship 2024 The Ultimate Showdown Unveiled

- Inside The Walls Exploring George W Hill Correctional Facility Pa

What Exactly is a Billing Address?

A billing address is the location associated with your payment method. It’s the address where your bank or credit card issuer has your account registered. When you’re making a purchase, whether online or in person, businesses use this address to verify that you’re the rightful owner of the payment method being used. It’s like a digital handshake that says, “Yeah, this person is legit.”

Here’s the kicker: your billing address doesn’t have to be where you physically live. For example, if you have a credit card issued in one country but you’re living abroad, your billing address will still be the one on file with your card issuer. This is why it’s super important to keep your billing address updated with your bank or credit card company. If it’s outdated, things can get complicated fast.

Why Does a Billing Address Matter?

Alright, so now you know what a billing address is, but why does it even matter? Well, it matters for a bunch of reasons, and here’s the breakdown:

- How Many Gatorade Flavors Are There A Deep Dive Into The World Of Thirstquenching Refreshment

- Catawba County Whos In Jail The Ultimate Guide To Understanding Local Incarceration

- Security: Your billing address is a key part of fraud prevention. When you enter it during a transaction, businesses can cross-check it with your payment method to ensure everything checks out.

- Verification: It helps confirm that you’re the actual owner of the payment method being used. This is especially important for online transactions where identity theft is a real concern.

- Legal Stuff: In some cases, your billing address can affect things like taxes and compliance with local regulations. For example, if you’re buying from an international seller, your billing address might determine whether you owe import duties.

See? Your billing address isn’t just a random field on a form—it’s a crucial piece of the puzzle when it comes to secure and seamless transactions.

How Does a Billing Address Work?

Now that we’ve established what a billing address is and why it’s important, let’s talk about how it actually works. When you enter your billing address during a transaction, here’s what typically happens behind the scenes:

First, the merchant sends your billing address to the payment processor, which then forwards it to your bank or credit card issuer. The issuer checks the address against the one they have on file for your account. If everything matches, the transaction is approved. If there’s a mismatch, the transaction might be flagged for review or even declined. It’s like a digital game of “match the address,” and if you don’t win, you might not get what you’re trying to buy.

Common Billing Address Mistakes to Avoid

Let’s face it: we’ve all made mistakes when filling out forms, and billing addresses are no exception. Here are some common errors to watch out for:

- Typing Errors: A simple typo can cause your transaction to be declined. Double-check your address before hitting “submit.”

- Using the Wrong Address: If you’re using a prepaid card or gift card, make sure you’re entering the billing address associated with that card, not your home address.

- Forgetting to Update: If you’ve moved recently, don’t forget to update your billing address with your bank or credit card company. Otherwise, you might run into issues when making purchases.

These mistakes might seem small, but they can cause big headaches. Trust me, nobody wants to deal with a declined transaction just because of a typo.

Can Your Billing Address Be Different from Your Shipping Address?

This is one of the most common questions people have about billing addresses, and the answer is a resounding yes! Your billing address and shipping address can absolutely be different. In fact, it’s pretty common, especially for people who shop online for gifts or have their purchases shipped to a different location.

For example, let’s say you’re buying a gift for a friend who lives in another city. You can enter your billing address (where your credit card is registered) and a different shipping address (your friend’s address) without any issues. Just make sure both addresses are accurate and up-to-date to avoid any hiccups during the transaction process.

What Happens If Your Billing Address Doesn’t Match?

Now, here’s the thing: if your billing address doesn’t match the one on file with your bank or credit card issuer, there’s a good chance your transaction will be flagged or declined. This is because businesses use billing address verification as a security measure to prevent fraud. If there’s a mismatch, the payment processor might suspect that something fishy is going on, even if it’s just a simple typo.

That being said, some merchants are more flexible than others. Some might allow the transaction to go through even if there’s a slight mismatch, while others might require you to contact your bank to resolve the issue. It all depends on the merchant’s policies and the level of risk they’re willing to take.

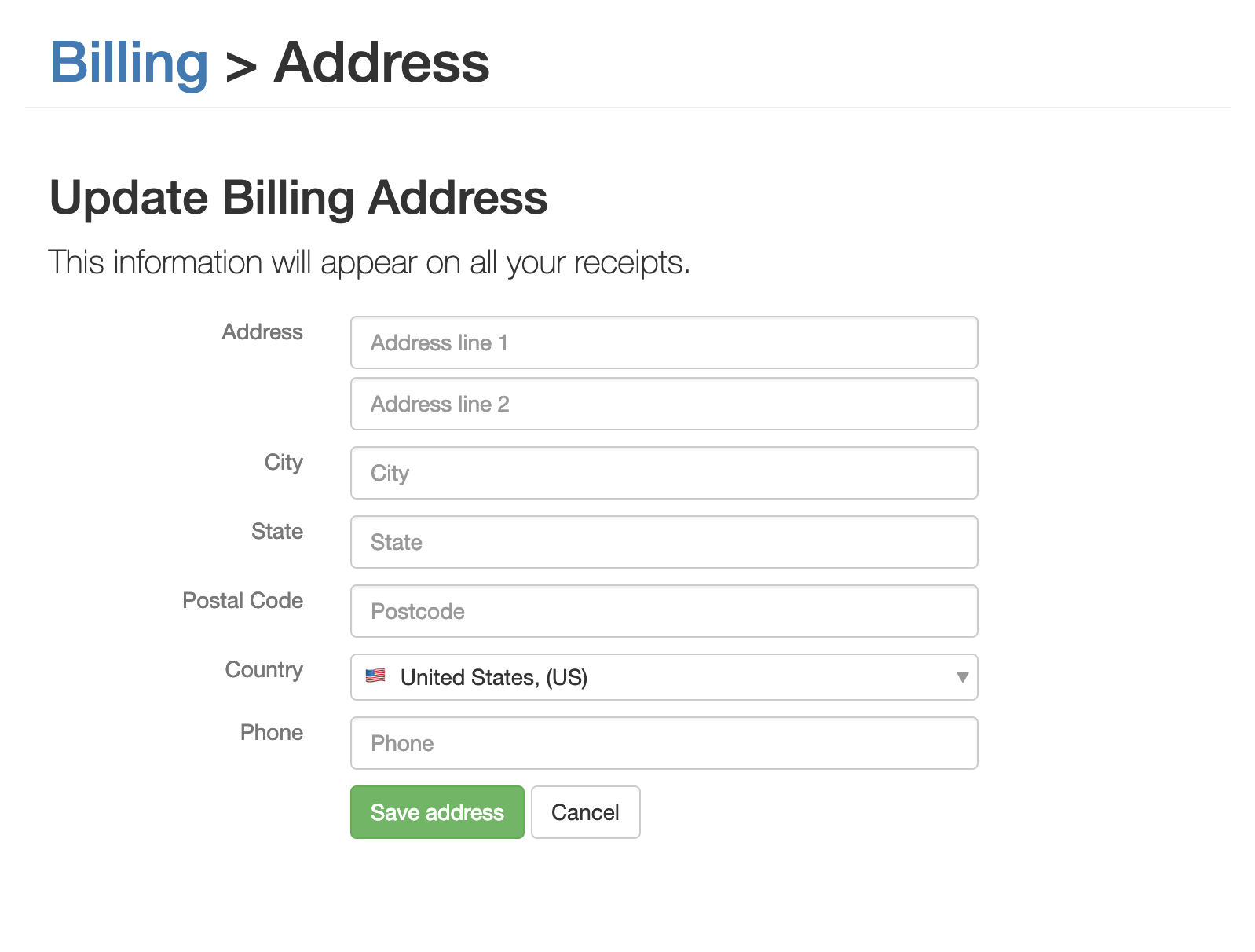

How to Update Your Billing Address

If your billing address is outdated or incorrect, it’s super important to update it as soon as possible. Here’s how you can do it:

For Banks: Log in to your online banking account and look for the option to update your personal information. You might need to provide proof of your new address, like a utility bill or a driver’s license. Once your bank has updated your address, you’re good to go.

For Credit Cards: Most credit card issuers allow you to update your billing address through their online portal or mobile app. Just log in, find the section for updating your personal information, and follow the prompts. Again, you might need to provide proof of your new address, so have that handy.

Updating your billing address might seem like a hassle, but trust me, it’s way better than dealing with declined transactions or fraud alerts.

Tips for Keeping Your Billing Address Secure

Now that you know how to update your billing address, let’s talk about how to keep it secure. Here are some tips to help protect your billing address and prevent fraud:

- Monitor Your Accounts: Regularly check your bank and credit card statements for any suspicious activity. If you notice anything weird, report it immediately.

- Use Strong Passwords: Make sure your online banking and credit card accounts are protected with strong, unique passwords. Avoid using the same password for multiple accounts.

- Be Wary of Phishing Scams: If you receive an email or text claiming to be from your bank or credit card issuer asking for your billing address, don’t fall for it. Always go directly to the official website or app to update your information.

By following these tips, you can help ensure that your billing address stays safe and secure.

What Happens If Someone Uses Your Billing Address Without Permission?

Unfortunately, billing address fraud is a real thing, and it can happen to anyone. If someone uses your billing address without your permission, here’s what you need to do:

Act Fast: Contact your bank or credit card issuer immediately to report the fraud. They’ll likely freeze your account and issue a new card with a new billing address to prevent further unauthorized transactions.

Monitor Your Credit: Keep an eye on your credit report for any suspicious activity. You can request a free credit report from each of the three major credit bureaus once a year. It’s a good idea to do this regularly, especially if you’ve been a victim of fraud.

File a Police Report: If the fraud is severe, consider filing a police report. This can help you if you need to dispute any charges or prove that you were a victim of fraud.

Remember, the sooner you act, the better your chances of minimizing the damage.

How to Prevent Billing Address Fraud

Prevention is always better than cure, so here are some steps you can take to prevent billing address fraud:

- Use Two-Factor Authentication: Enable two-factor authentication on your online banking and credit card accounts. This adds an extra layer of security to your accounts.

- Avoid Public Wi-Fi: Never access your banking or credit card accounts on public Wi-Fi. It’s just not worth the risk.

- Shred Sensitive Documents: If you have any documents with your billing address on them, make sure to shred them before throwing them away. This can help prevent dumpster divers from getting their hands on your information.

By taking these precautions, you can help protect yourself from billing address fraud and keep your personal information safe.

Conclusion: Why Understanding Your Billing Address is Key

So, there you have it—everything you need to know about billing addresses in one handy guide. From what they are to how they work and why they matter, understanding your billing address can make your life a whole lot easier when it comes to making purchases and managing your finances.

Remember, your billing address isn’t just a random field on a form—it’s a crucial part of the transaction process. By keeping it updated, secure, and accurate, you can avoid a lot of headaches and ensure that your transactions go smoothly every time.

Now that you’re an expert on billing addresses, why not share this article with your friends and family? Trust me, they’ll thank you for it. And if you have any questions or comments, feel free to drop them below. We’d love to hear from you!

Table of Contents

- What Exactly is a Billing Address?

- Why Does a Billing Address Matter?

- How Does a Billing Address Work?

- Common Billing Address Mistakes to Avoid

- Can Your Billing Address Be Different from Your Shipping Address?

- What Happens If Your Billing Address Doesn’t Match?

- How to Update Your Billing Address

- Tips for Keeping Your Billing Address Secure

- What Happens If Someone Uses Your Billing Address Without Permission?

- How to Prevent Billing Address Fraud

- Did Stevan And Alara Break Up The Inside Scoop Yoursquove Been Waiting For

- April 17 Zodiac Sign Discover The Traits And Secrets Of Your Star Sign

How can I update my billing address? DocHub

How do I update my billing address? Basecamp Help

Use “Shipping Address” as “Billing Address” by Default (16 of Mobile