What Is Netspend: A Comprehensive Guide To Understanding The Future Of Digital Banking

Let me drop some knowledge on you about Netspend, because this ain't just another financial tool—it's a game-changer. Imagine having control over your money without all the hassle of traditional banks. Netspend is like your personal finance assistant that fits right in your pocket. Whether you're paying bills, managing expenses, or even building credit, Netspend's got your back. So, buckle up, because we're diving deep into what makes Netspend tick.

You might be thinking, "What’s the big deal about Netspend?" Well, my friend, Netspend isn’t just some random prepaid card service. It’s a powerful financial platform designed to give you the flexibility and freedom to manage your money without the strings attached by traditional banks. And let’s be real, who doesn’t want that kind of freedom?

Now, before we get too deep into the nitty-gritty, let me set the stage. Netspend has been around for a while now, quietly revolutionizing the way people handle their finances. It’s not just about convenience—it’s about empowerment. Whether you’re a student trying to keep track of your spending or a small business owner looking for a reliable way to manage cash flow, Netspend offers solutions tailored to your needs. So, let’s dig in and find out why everyone’s talking about it.

- Sam Elliott And His Son A Heartwarming Journey Of Legacy And Bonding

- Nathan Charles Summers The Rising Star You Need To Know

Table of Contents

- What is Netspend?

- How Does Netspend Work?

- Key Features of Netspend

- Benefits of Using Netspend

- Costs and Fees

- Netspend Security: How Safe Is It?

- Netspend vs. Traditional Banks

- Who Can Use Netspend?

- Tips for Maximizing Netspend

- The Future of Netspend

What is Netspend?

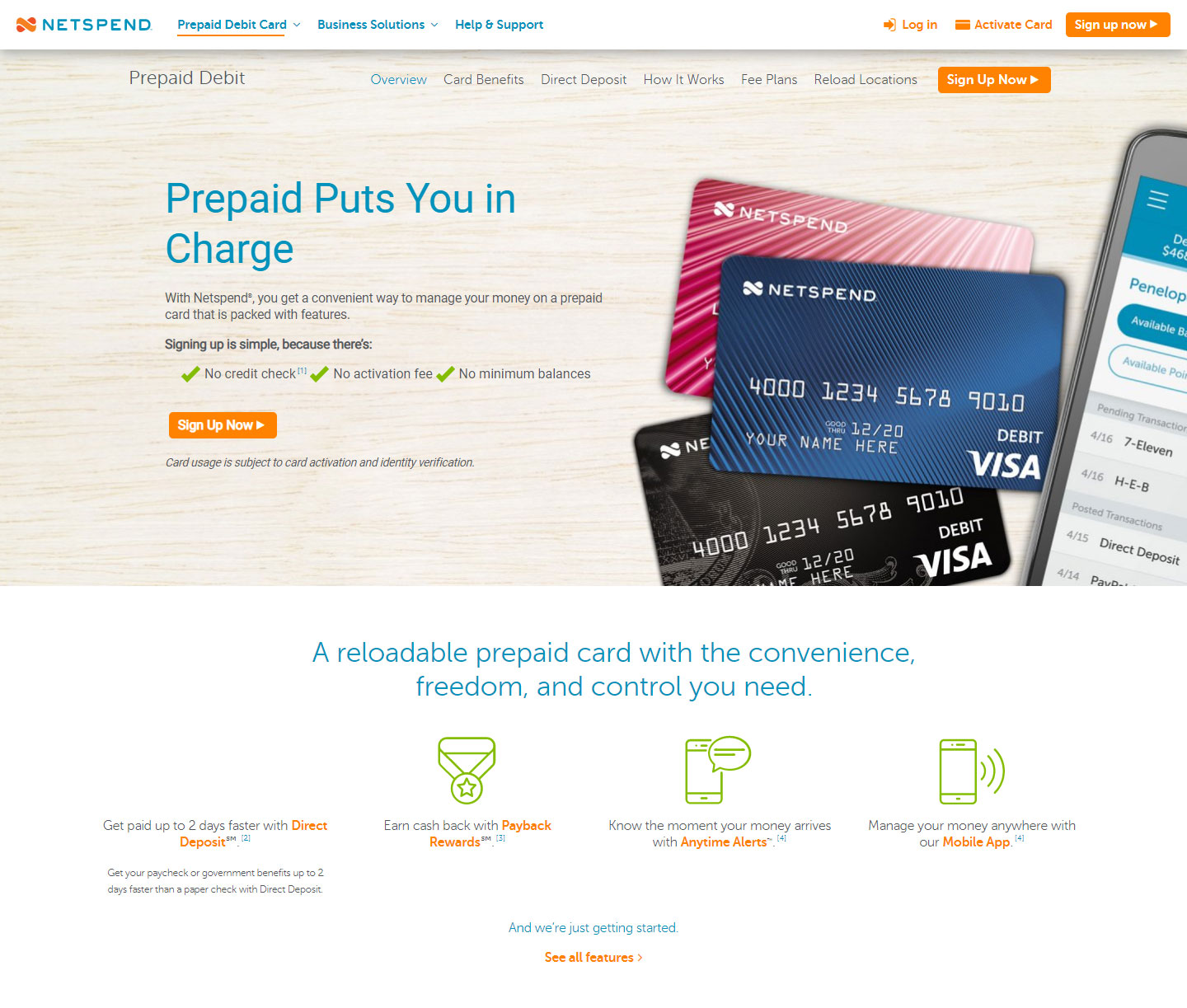

Netspend is basically a prepaid card and financial services provider that offers a range of tools to help you manage your money more effectively. It’s not a bank, but it provides many of the same services you’d expect from one. Think of it as your personal finance guru, but instead of advice, it gives you tools to make smarter financial decisions. And here’s the kicker—it doesn’t require a credit check or a minimum balance to use.

Now, let’s break it down a bit. Netspend started out as a simple prepaid card service, but over the years, it’s evolved into something much bigger. Today, it offers everything from bill payment services to mobile check deposits. It’s like having a mini-bank in your pocket, but without all the red tape.

Why Netspend Stands Out

One of the reasons Netspend is so popular is because it caters to people who might not have access to traditional banking services. Maybe you don’t have a credit history, or maybe you just don’t want to deal with all the fees that come with a regular bank account. Netspend fills that gap by offering a simple, straightforward way to manage your money.

- Outlander Character Jamie A Deep Dive Into The Heartthrob Of The Series

- Amanda Beery The Rising Star You Need To Know

And guess what? Netspend doesn’t just stop at prepaid cards. They’ve got apps, online banking, and even tools to help you build credit. So, if you’re looking for a one-stop-shop for all your financial needs, Netspend might just be the answer you’ve been searching for.

How Does Netspend Work?

Alright, let’s get into the nuts and bolts of how Netspend works. First things first, you sign up for an account. You can do this online or through the app, and it’s super easy. Once you’ve got your account set up, you can load money onto your Netspend card using a variety of methods—direct deposit, cash loads, or even mobile check deposits.

Now, here’s where it gets interesting. Once your money’s loaded, you can use your Netspend card just like any other debit card. You can pay bills, make purchases online or in-store, and even withdraw cash from ATMs. And the best part? You can track all your transactions through the app, so you always know where your money’s going.

Loading Your Card

There are several ways to load money onto your Netspend card, and each has its own benefits. Here’s a quick rundown:

- Direct Deposit: This is probably the easiest way to load your card. Just set up direct deposit with your employer, and your paycheck will hit your account automatically.

- Cash Loads: If you prefer cash, you can load your card at participating retailers. It’s a bit more hands-on, but it works great if you don’t have access to online banking.

- Mobile Check Deposits: This one’s pretty cool. You can deposit checks directly into your account using the Netspend app. No need to visit a bank or ATM.

Key Features of Netspend

Netspend isn’t just about prepaid cards. It’s packed with features that make managing your money easier than ever. Let’s take a look at some of the standout features:

1. Bill Payment Services

Pay your bills directly from your Netspend account. No more scrambling to find checks or worrying about late fees. Just set up autopay, and you’re good to go.

2. Mobile Banking

Check your balance, view transactions, and even deposit checks—all from your phone. Mobile banking with Netspend is fast, secure, and super convenient.

3. Credit Building Tools

One of the coolest features of Netspend is its credit-building tools. If you’ve got bad credit or no credit at all, Netspend can help you build it up over time. It’s like a financial safety net for people who need a second chance.

Benefits of Using Netspend

So, why should you choose Netspend over other financial services? Here are a few reasons:

- No Credit Check: You don’t need a credit history to use Netspend, which makes it perfect for people who are just starting out or rebuilding their credit.

- No Minimum Balance: Unlike traditional banks, Netspend doesn’t require you to maintain a minimum balance. That means you can manage your money without worrying about hidden fees.

- Convenience: With features like mobile check deposits and bill payment services, Netspend makes it easy to manage your finances on the go.

Costs and Fees

Now, let’s talk about the elephant in the room—fees. Like any financial service, Netspend does charge fees, but they’re pretty reasonable compared to some of the big banks. Here’s a breakdown of what you can expect:

- Monthly Fee: Most plans come with a small monthly fee, but you can usually waive it by meeting certain requirements, like setting up direct deposit.

- ATM Fees: If you use an out-of-network ATM, you might incur a small fee. But Netspend does offer a network of fee-free ATMs, so it’s worth checking those out.

- Other Fees: There are a few other fees for things like cash loads and check deposits, but they’re pretty standard for prepaid card services.

Netspend Security: How Safe Is It?

Security is a big deal when it comes to financial services, and Netspend takes it seriously. All transactions are encrypted, and your card is protected by fraud detection tools. Plus, if your card ever gets lost or stolen, you can easily freeze it through the app.

And here’s another cool feature—Netspend offers purchase protection on eligible purchases. So, if something goes wrong with a purchase, you’ve got a safety net to fall back on.

Netspend vs. Traditional Banks

Now, let’s compare Netspend to traditional banks. On one hand, traditional banks offer a wider range of services, like loans and mortgages. But on the other hand, they often come with a lot of fees and requirements that can be a pain to deal with.

Netspend, on the other hand, is all about simplicity. No credit checks, no minimum balances, and no hidden fees. It’s perfect for people who just want a straightforward way to manage their money. Plus, with features like mobile check deposits and credit-building tools, Netspend offers a lot of the same benefits as a traditional bank, but without all the hassle.

Who Can Use Netspend?

Almost anyone can use Netspend, but there are a few requirements. First, you need to be at least 18 years old. Second, you’ll need to provide some basic identification information when you sign up. And finally, you’ll need a way to load money onto your card, whether that’s through direct deposit, cash loads, or mobile check deposits.

That’s pretty much it. No credit checks, no minimum balances, and no complicated requirements. Netspend is designed to be accessible to everyone, regardless of their financial situation.

Tips for Maximizing Netspend

Now that you know the basics, here are a few tips to help you get the most out of Netspend:

- Set Up Direct Deposit: This is the easiest way to load your card, and it can help you avoid monthly fees.

- Use Fee-Free ATMs: Netspend has a network of fee-free ATMs, so take advantage of them to save money.

- Track Your Spending: Use the app to keep an eye on your transactions and make sure you’re staying within budget.

The Future of Netspend

So, where’s Netspend headed in the future? Well, if the past is any indication, they’re going to keep innovating and expanding their services. With features like credit-building tools and mobile check deposits, Netspend is already ahead of the curve. But as technology continues to evolve, you can expect even more exciting developments from this financial powerhouse.

Whether it’s integrating with new payment platforms or offering even more tools to help you manage your money, Netspend is poised to continue leading the charge in the world of digital banking. And for anyone looking for a simple, effective way to manage their finances, that’s great news.

Conclusion

Alright, let’s recap. Netspend is a prepaid card and financial services provider that offers a range of tools to help you manage your money more effectively. It’s simple, convenient, and accessible to just about everyone. Whether you’re looking to pay bills, manage expenses, or even build credit, Netspend has got you covered.

So, what are you waiting for? If you haven’t already, sign up for a Netspend account and see for yourself why everyone’s talking about it. And don’t forget to leave a comment or share this article with your friends. After all, knowledge is power, and the more people who know about Netspend, the better off we all are.

- Bad Traits Of Aquarius The Hidden Side Of The Water Bearer You Need To Know

- Georgia Groome Rising Star In The Spotlight

Is Netspend a credit card or debit? Leia aqui What type of card is

How to Find Netspend Reload Locations Near You? DeviceMAG

Netspend Login Sign In to Netspend Prepaid Account