NYC City Income Tax Rate: A Comprehensive Guide For Residents And Taxpayers

So, you're wondering about the nyc city income tax rate, huh? Let me break it down for you in a way that's easy to digest. Whether you're a new resident or just trying to figure out how much of your hard-earned cash goes to Uncle Sam—and the Big Apple—you're in the right place. This article is your go-to resource for understanding NYC's income tax structure and how it impacts your wallet.

Let's face it, taxes can be confusing. You've got federal, state, and now city taxes to think about. But don't worry, we're here to make sense of it all. NYC has its own set of rules when it comes to income tax, and understanding them is key to managing your finances effectively.

In this guide, we'll dive deep into the nyc city income tax rate, covering everything from the tax brackets to deductions and exemptions. By the end of this, you'll be equipped with the knowledge to make informed decisions about your taxes and maybe even save a buck or two.

- What Company Makes The Mini Cooper Unveiling The Iconic Brand Behind The Wheels

- Love Hip Hop Atlanta Cast The Ultimate Guide To The Stars Who Keep The Beat Alive

Understanding NYC Income Tax: Why It Matters

First things first, let's talk about why NYC income tax is such a big deal. Unlike most cities in the U.S., New York City imposes its own income tax on residents. This means that in addition to federal and state taxes, NYC residents have to pay an extra layer of taxation. But hey, living in the city that never sleeps comes with its own set of costs, right?

How NYC Income Tax Affects You

The nyc city income tax rate is progressive, meaning the more you earn, the more you pay. This structure ensures that those who earn more contribute a larger share to the city's coffers. Here's a quick rundown of how it works:

- Lower-income earners pay a smaller percentage of their income in taxes.

- Higher-income earners pay a higher percentage, but only on the portion of income that falls into the higher brackets.

- There are specific tax brackets that determine how much you owe based on your income level.

Understanding these brackets is crucial for planning your finances and making the most of any available deductions or credits.

- What Is Dora The Explorer Nationality Unveiling The Cultural Roots Of A Beloved Character

- Unveiling The Power Of Namari A Comprehensive Guide

NYC City Income Tax Rate Breakdown

Alright, let's get into the nitty-gritty of the nyc city income tax rate. As of the latest data, NYC uses a progressive tax system with several brackets. Here's a simplified version of the brackets:

Income Tax Brackets for NYC Residents

For single filers:

- $0 - $12,499: 3.078%

- $12,500 - $24,999: 3.934%

- $25,000 - $41,699: 4.346%

- $41,700 - $50,000: 4.626%

- $50,001 and above: 4.878%

These rates are subject to change, so it's always a good idea to check the latest updates from official sources like the NYC Department of Finance.

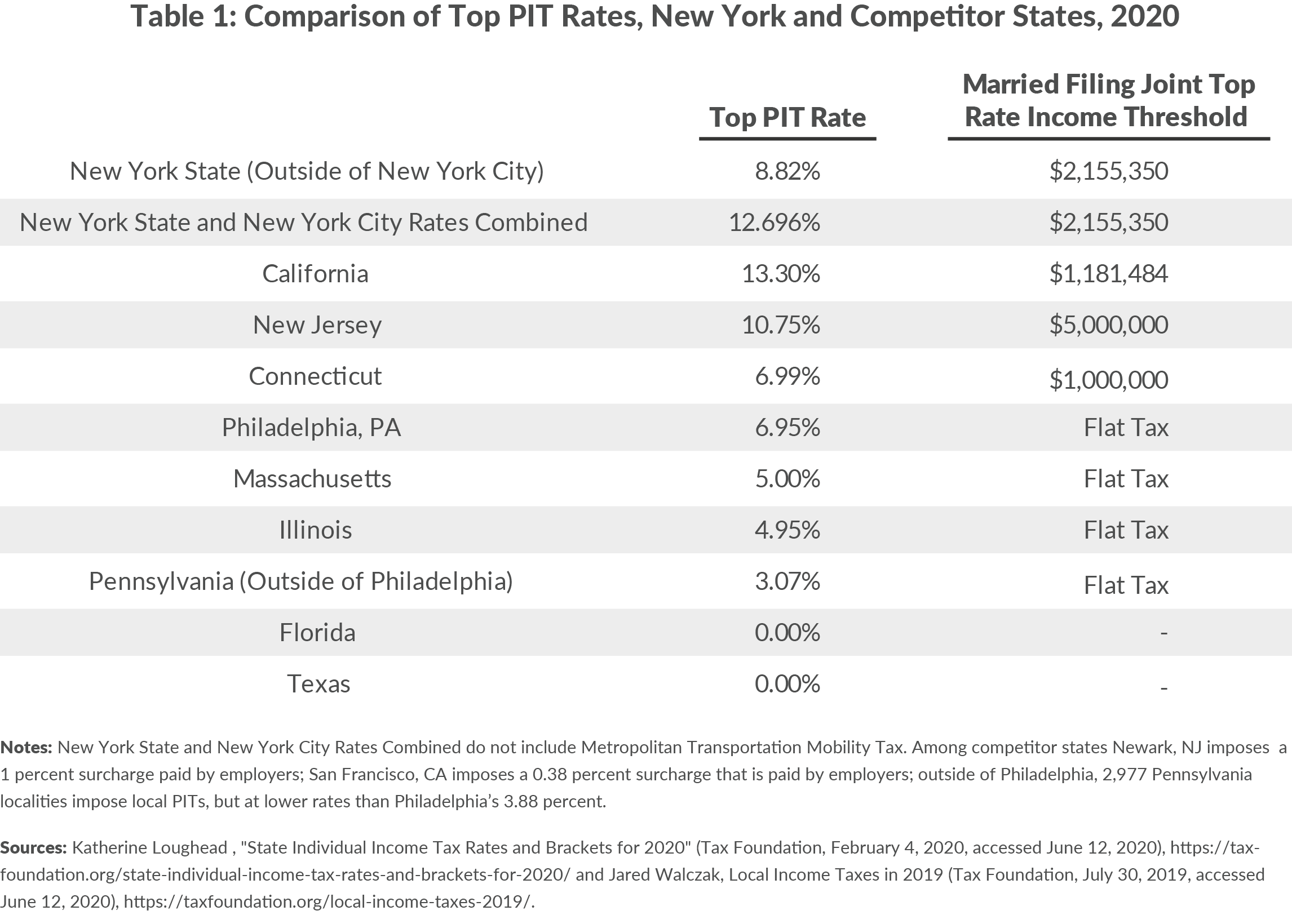

How NYC Income Tax Compares to Other Cities

Now, you might be wondering how NYC's income tax stacks up against other major cities. The truth is, not many cities in the U.S. have their own income tax. Most rely on property taxes or sales taxes to generate revenue. NYC, being the financial hub that it is, has chosen to implement an income tax to support its vast array of public services.

Key Differences

Here's a quick comparison:

- Chicago: No city income tax

- Los Angeles: No city income tax

- Philadelphia: City income tax, but at a lower rate than NYC

As you can see, NYC's approach is unique, and it reflects the city's need to fund its extensive infrastructure and services.

Who Pays NYC City Income Tax?

Not everyone who works in NYC has to pay the city income tax. Generally, the tax applies to residents who live and work in the city. But what about commuters or those who work remotely? Let's break it down:

Resident vs. Non-Resident Taxpayers

Residents:

- Live in NYC for more than 183 days of the year

- Pay NYC city income tax on all income earned, regardless of where it's earned

Non-Residents:

- Work in NYC but don't meet the residency requirements

- Only pay NYC city income tax on income earned within the city

Knowing your status is important, as it affects how much tax you owe and how you file your returns.

Calculating Your NYC Income Tax

Figuring out how much you owe in NYC income tax can seem daunting, but it's actually pretty straightforward once you know the steps. Here's a quick guide:

Step-by-Step Process

- Determine your taxable income by subtracting any applicable deductions and exemptions.

- Find the tax bracket that corresponds to your income level.

- Calculate the tax owed using the appropriate rate for each portion of your income that falls into different brackets.

For example, if you earn $50,000, you'd pay 3.078% on the first $12,499, 3.934% on the next $12,500, and so on, until you reach the highest bracket for your income level.

Common Deductions and Credits

One of the best ways to reduce your NYC income tax burden is by taking advantage of available deductions and credits. Here are some of the most common ones:

Deductions

- Standard deduction: Automatically reduces your taxable income

- Itemized deductions: Allows you to deduct specific expenses like mortgage interest or charitable contributions

Credits

- Child tax credit: Helps offset the cost of raising children

- Energy credit: Encourages energy-efficient home improvements

Be sure to explore all the options available to you, as they can significantly lower your tax bill.

Tips for Filing NYC Income Tax

Filing your NYC income tax doesn't have to be a headache. Here are some tips to make the process smoother:

Organize Your Documents

Before you start, gather all the necessary documents:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Receipts for any deductions or credits you plan to claim

Use Tax Software or a Professional

Consider using tax software or hiring a tax professional if you're unsure about how to file. They can ensure you're taking advantage of all available deductions and credits.

Impact of NYC Income Tax on Your Finances

Paying NYC city income tax is just one piece of the financial puzzle. It's important to consider how it fits into your overall budget and financial goals. Here are some ways to manage the impact:

Plan Ahead

Set aside a portion of each paycheck to cover your tax liability. This way, you won't be caught off guard when tax season rolls around.

Review Your Withholding

Make sure your employer is withholding the correct amount of tax from your paycheck. If not, you might end up owing a large sum at tax time.

Looking Ahead: Future Changes to NYC Income Tax

Tax laws are always subject to change, and NYC is no exception. Keep an eye on any proposed changes to the nyc city income tax rate, as they could affect your tax liability in the future. Staying informed is the best way to prepare for any potential changes.

Conclusion

Understanding the nyc city income tax rate is essential for anyone living or working in the Big Apple. By familiarizing yourself with the tax brackets, deductions, and credits available, you can make the most of your financial situation. Remember, planning ahead and staying organized are key to managing your tax obligations effectively.

So, what's next? Take a moment to review your finances and see where you can make adjustments. And if you found this guide helpful, don't forget to share it with your friends and family. Knowledge is power, and when it comes to taxes, being informed can save you money.

Table of Contents:

- Understanding NYC Income Tax: Why It Matters

- NYC City Income Tax Rate Breakdown

- How NYC Income Tax Compares to Other Cities

- Who Pays NYC City Income Tax?

- Calculating Your NYC Income Tax

- Common Deductions and Credits

- Tips for Filing NYC Income Tax

- Impact of NYC Income Tax on Your Finances

- Looking Ahead: Future Changes to NYC Income Tax

- Conclusion

- Nv Snap The Ultimate Guide To Unleashing Your Creativity

- Frankie Beverlys First Wife Unveiling The Hidden Story Behind The Music Icon

2021 nyc tax brackets fopttokyo

New York Budget Gap Options for Addressing New York Revenue Shortfall

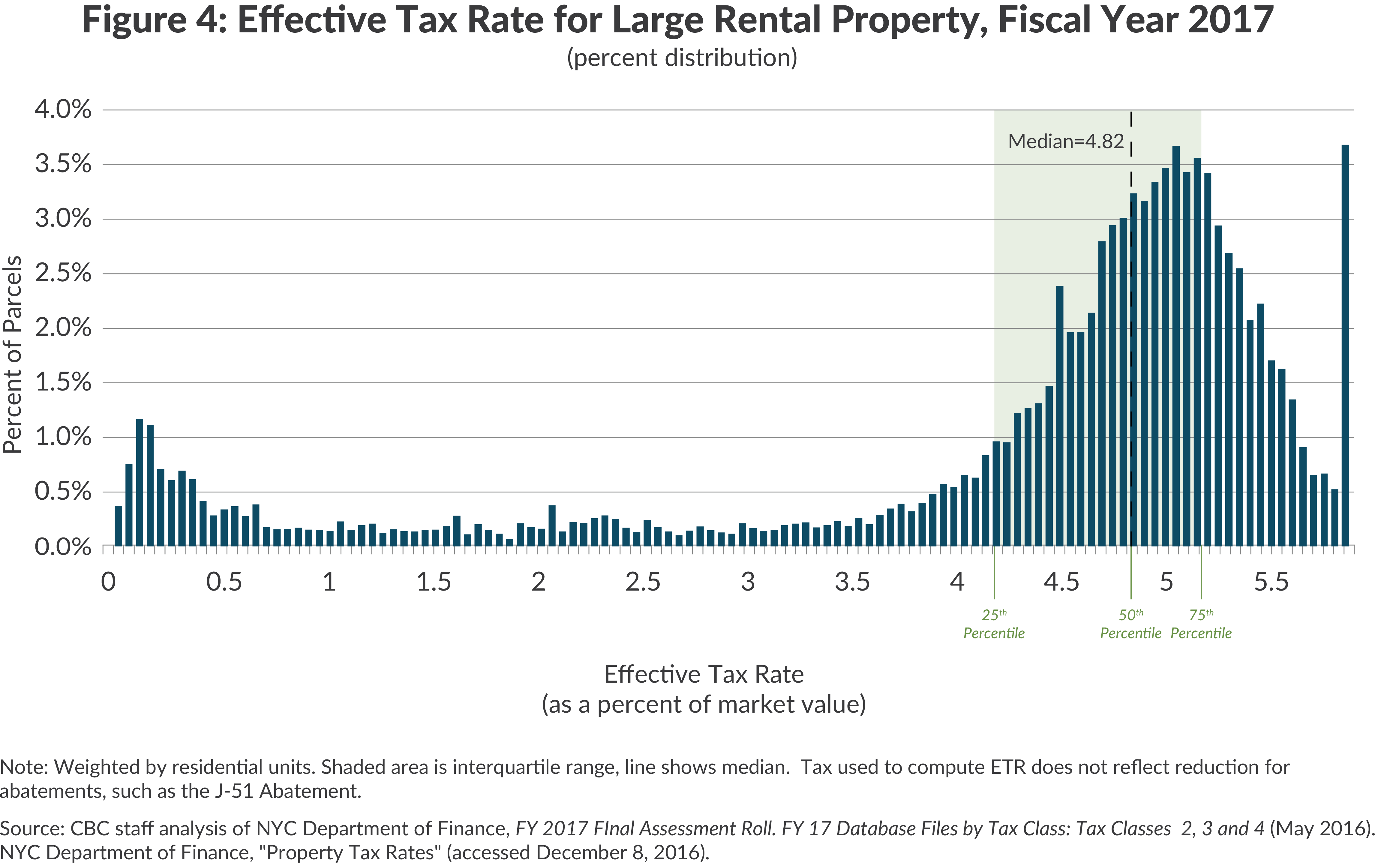

NYC Effective Tax Rates CBCNY