Fidelity Contribution: Unlocking The Power Of Financial Growth

Hey there, future financial rockstar! Are you ready to dive into the world of fidelity contributions and take charge of your financial destiny? Whether you're a beginner or someone looking to refine their investment strategy, this guide has got you covered. Fidelity contribution is more than just putting money into an account; it's about building a secure future, one step at a time. So, grab your favorite drink, and let's get started on this exciting journey!

Let's face it, money can be a tricky beast to tame. But here's the thing: with the right tools and knowledge, you can turn that beast into your best friend. Fidelity contributions are one of those tools that can help you harness the power of compound interest and long-term growth. Imagine your money working for you while you focus on living your life. Sounds pretty sweet, right?

Now, before we dive deeper, let me tell you something cool. Fidelity contributions aren't just for the wealthy or the finance wizards. They're for anyone who's serious about securing their financial future. And guess what? You don't need a PhD in economics to understand them. All you need is a bit of curiosity and a willingness to learn. So, let's roll up our sleeves and explore the ins and outs of fidelity contributions together!

- What Is Dora The Explorer Nationality Unveiling The Cultural Roots Of A Beloved Character

- Tupac Age Exploring The Legacy Of An Iconic Legend

What Exactly is Fidelity Contribution?

Alright, let's break it down. A fidelity contribution is essentially the amount of money you contribute to a fidelity account, which is typically tied to retirement plans like 401(k) or IRAs. Think of it as planting a seed today that will grow into a mighty tree tomorrow. The more you contribute, the bigger your tree grows. But here's the kicker: it's not just about the amount you put in; it's also about how you manage it.

One of the coolest things about fidelity contributions is the power of compounding. This means that over time, your contributions earn interest, and that interest also earns interest. It's like a snowball rolling down a hill, getting bigger and bigger as it goes. The earlier you start contributing, the more time your money has to grow. So, if you're in your 20s or 30s, now's the perfect time to jump in!

Why Should You Care About Fidelity Contribution?

Here's the deal: life is expensive. From buying a house to sending kids to college, there are so many financial goals that require serious cash. Fidelity contributions can help you achieve those goals by giving your money a chance to grow over time. Plus, many employers offer matching contributions, which is essentially free money! Who doesn't love free money, right?

- Carey Grant The Timeless Icon Who Redefined Hollywood Glamour

- Venezuela Traditions A Colorful Journey Through Rich Cultural Heritage

Another reason to care about fidelity contributions is the tax benefits. Depending on the type of account you choose, you might get tax deductions now or tax-free withdrawals later. It's like getting a little bonus from Uncle Sam for being responsible with your finances. And let's be honest, who doesn't want to keep more of their hard-earned cash?

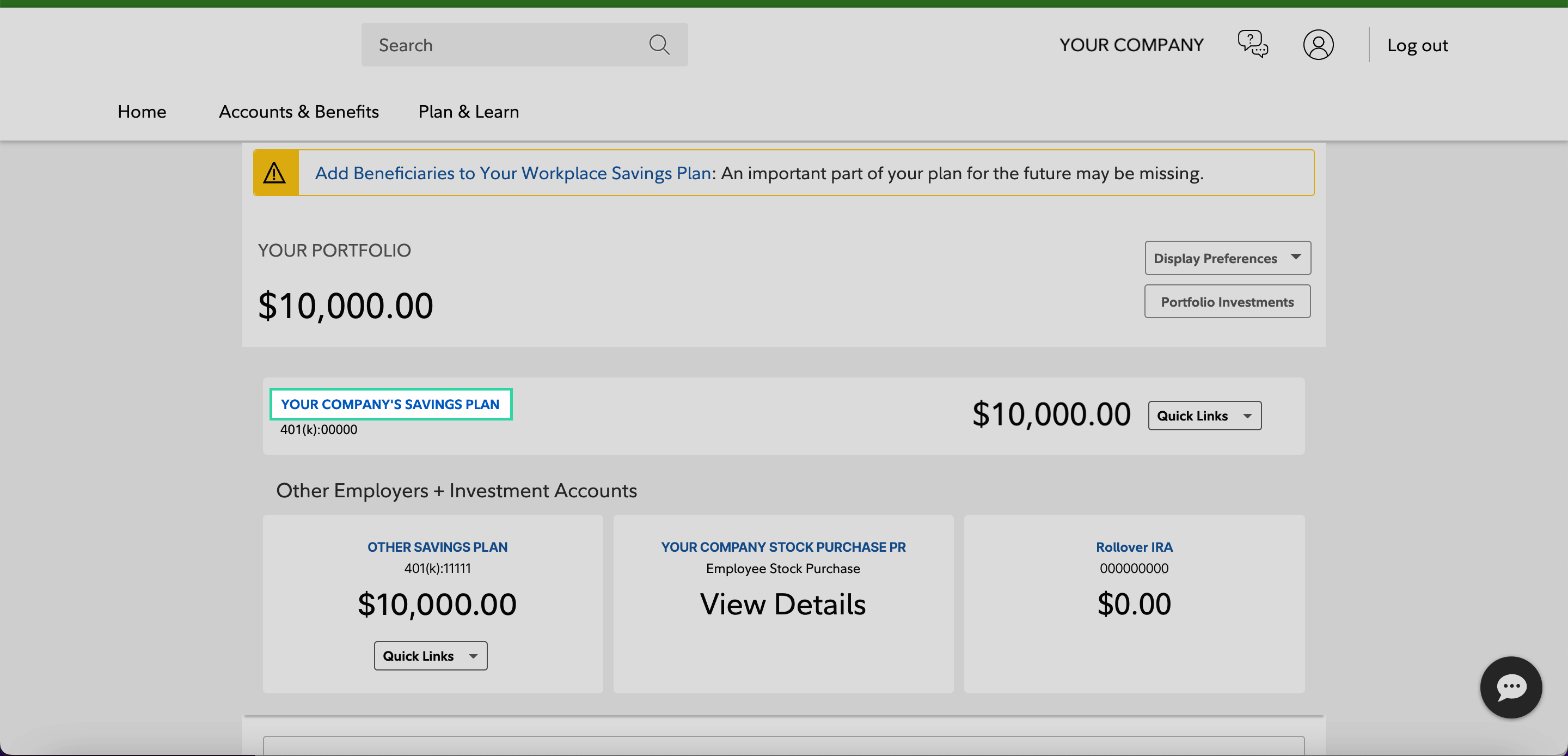

How to Start Your Fidelity Contribution Journey

Starting your fidelity contribution journey doesn't have to be overwhelming. Here's a quick breakdown of the steps you can take:

- Assess your financial goals: Figure out what you're saving for and how much you'll need.

- Choose the right account type: Decide between a traditional IRA, Roth IRA, or 401(k) based on your needs.

- Determine your contribution amount: Start small if you need to, but aim to increase it over time.

- Set up automatic contributions: This way, you won't even have to think about it.

Remember, consistency is key. Even if you can only contribute a small amount each month, it all adds up over time. And don't forget to review your contributions regularly to make sure they align with your goals.

Common Misconceptions About Fidelity Contributions

There are a few myths floating around about fidelity contributions that might be holding people back. Let's debunk them one by one:

- Myth 1: It's only for the wealthy. Nope! Anyone can benefit from fidelity contributions, regardless of income level.

- Myth 2: It's too complicated. Not true! With a bit of research and guidance, anyone can understand how it works.

- Myth 3: You need a ton of money to get started. Wrong! You can start with as little as $50 a month.

Don't let these misconceptions keep you from taking advantage of the benefits fidelity contributions offer. Knowledge is power, and the more you know, the better equipped you'll be to make smart financial decisions.

Maximizing Your Fidelity Contribution Potential

Now that you know the basics, let's talk about how to maximize your fidelity contribution potential. Here are a few tips to help you get the most out of your contributions:

Tip 1: Take Advantage of Employer Matching

If your employer offers a matching contribution, make sure you're contributing enough to get the full match. It's like leaving free money on the table if you don't!

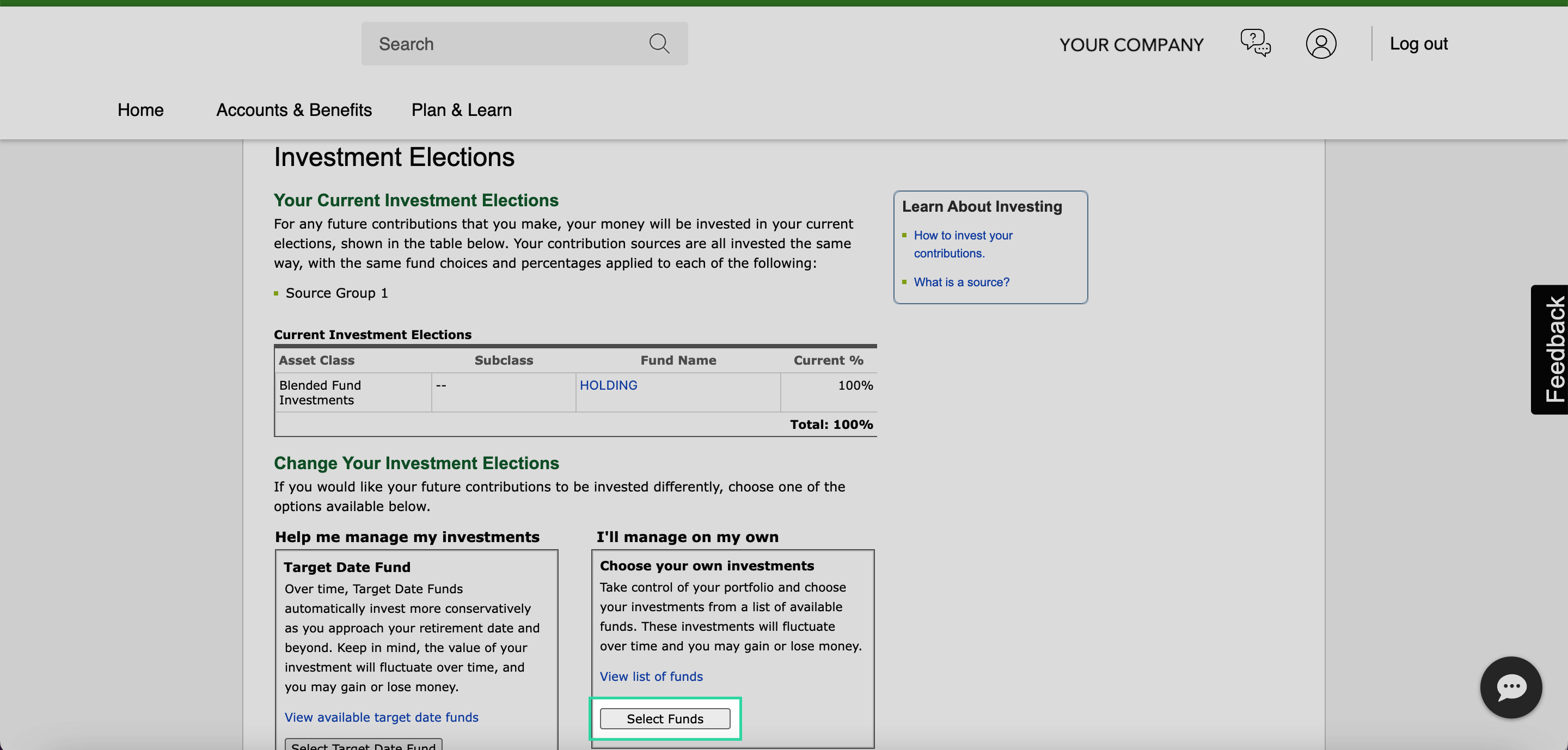

Tip 2: Diversify Your Investments

Don't put all your eggs in one basket. Spread your contributions across different asset classes to reduce risk and increase potential returns.

Tip 3: Stay Consistent

Consistency is key when it comes to fidelity contributions. Stick to your plan, even when the market gets bumpy. History has shown that long-term investors tend to come out on top.

Understanding the Tax Benefits of Fidelity Contributions

Taxes can be a real buzzkill, but fidelity contributions offer some sweet tax benefits that can help ease the pain. Here's how:

- Traditional IRA: Contributions may be tax-deductible, and withdrawals are taxed as income in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals are tax-free in retirement.

- 401(k): Contributions are pre-tax, reducing your taxable income for the year.

Choosing the right type of account depends on your current tax situation and your expectations for the future. It's always a good idea to consult with a financial advisor to determine the best option for you.

Overcoming Common Challenges in Fidelity Contributions

Let's be real, life happens. There might be times when contributing to your fidelity account feels like a stretch. Here's how to overcome some common challenges:

Challenge 1: Budget Constraints

If money is tight, start small. Even contributing a little each month can make a big difference over time. As your income grows, gradually increase your contributions.

Challenge 2: Market Volatility

Don't panic when the market dips. Stick to your plan and remember that long-term investing is all about riding out the ups and downs.

Challenge 3: Keeping Track

Use online tools and apps to monitor your contributions and track your progress. Many fidelity accounts offer mobile apps that make it easy to stay on top of things.

The Role of Fidelity Contributions in Retirement Planning

Retirement might seem like a long way off, but it's never too early to start planning. Fidelity contributions play a crucial role in building a secure retirement. By consistently contributing to your account, you're giving your money the time it needs to grow. And with the power of compounding, even small contributions can add up to a significant nest egg.

Don't forget to factor in inflation when planning for retirement. What seems like a lot of money today might not go as far in 20 or 30 years. That's why it's important to contribute as much as you can and invest wisely.

Case Studies: Real-Life Examples of Fidelity Contributions

Let's take a look at a couple of real-life examples to see how fidelity contributions can make a difference:

Example 1: Sarah's Story

Sarah started contributing to her fidelity account in her early 30s. By consistently putting away $500 a month and taking advantage of her employer's match, she built a substantial retirement fund by the time she reached her 60s. Today, she enjoys a comfortable retirement, traveling the world and spending time with her grandkids.

Example 2: John's Journey

John didn't start saving for retirement until his 40s, but he was determined to catch up. By maxing out his fidelity contributions each year and investing in a diversified portfolio, he was able to build a solid nest egg. Now in his 60s, he's enjoying a fulfilling retirement, pursuing his passions and giving back to his community.

Final Thoughts: Take Action Today

So, there you have it, folks! Fidelity contributions are a powerful tool for building a secure financial future. Whether you're just starting out or looking to refine your strategy, the key is to take action today. The earlier you start, the more time your money has to grow.

Don't forget to review your contributions regularly and adjust them as needed to stay on track with your goals. And if you're ever unsure, don't hesitate to seek advice from a trusted financial professional.

Now, it's your turn! Share your thoughts in the comments below. Are you already contributing to a fidelity account, or are you thinking about starting? Whatever your situation, remember that taking control of your finances is one of the best investments you can make in yourself. So, what are you waiting for? Let's get to it!

Table of Contents

- What Exactly is Fidelity Contribution?

- Why Should You Care About Fidelity Contribution?

- How to Start Your Fidelity Contribution Journey

- Common Misconceptions About Fidelity Contributions

- Maximizing Your Fidelity Contribution Potential

- Understanding the Tax Benefits of Fidelity Contributions

- Overcoming Common Challenges in Fidelity Contributions

- The Role of Fidelity Contributions in Retirement Planning

- Case Studies: Real-Life Examples of Fidelity Contributions

- Final Thoughts: Take Action Today

- Rarity Eyes Unlocking The Mystique Behind The Most Coveted Eyewear

- Hereford High The Ultimate Guide To Understanding Its History Impact And Community

How to make changes to your Fidelity 401(k) portfolio Capitalize

14+ Fidelity Rebalance Tool WandaMarvin

Fidelity Logo 2024 Rodi Vivian