AZ EIN Search: The Ultimate Guide To Finding Your Arizona Employer Identification Number

Imagine this: you're sitting at your desk trying to figure out your Arizona Employer Identification Number (EIN) but can't seem to locate it. Don't worry, you're not alone. Thousands of small business owners and employees in Arizona face the same challenge daily. The good news? You're about to learn everything you need to know about Arizona EIN search and how to simplify the process.

Whether you're a business owner, an accountant, or just someone trying to get their paperwork in order, understanding the Arizona EIN system is crucial. This number is like a social security number for your business, and without it, things can get messy real quick.

In this article, we’ll break down the ins and outs of Arizona EIN search, from what it is to how to find it. We’ll also cover some tips and tricks to make the process easier, so grab your coffee and let's dive in!

- Fast Food Waco Tx Your Ultimate Guide To Tasty Eats In The Heart Of Texas

- Discover The Best Funeral Homes In Jasper Georgia For Your Needs

What Exactly is an Arizona Employer Identification Number (EIN)?

An Arizona EIN, also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the IRS to businesses operating in Arizona. It's used for tax administration purposes and is essential for filing taxes, opening business bank accounts, and hiring employees.

Think of your EIN as your business’s ID card. Just like you need an ID to prove who you are, businesses need an EIN to prove their legitimacy. Without one, you might face legal issues or delays in processing important documents.

For example, if you're starting a new business in Arizona, you'll need to apply for an EIN before you can even think about hiring staff or opening a business account. The IRS issues these numbers, but the state of Arizona may require additional documentation depending on your business type.

- Discovering The Best Gfs In Bradley Illinois Your Ultimate Guide

- Danielle Busby Weight Loss Journey Inspiring Transformation And Tips

Why Do You Need an Arizona EIN?

Let’s break it down: here are a few reasons why having an Arizona EIN is crucial:

- Filing Taxes: The IRS uses EINs to identify businesses when they file federal tax returns.

- Business Banking: Banks require an EIN to open a business account, ensuring secure financial transactions.

- Hiring Employees: If you plan to hire employees, you’ll need an EIN to report wages and pay payroll taxes.

- Legal Compliance: Having an EIN ensures your business complies with federal and state regulations.

Without an EIN, you might find yourself stuck in a bureaucratic loop, which no one has time for. So, it's important to know how to obtain or locate your Arizona EIN when needed.

How to Conduct an Arizona EIN Search

Now that you understand the importance of an EIN, let’s talk about how to find it. Whether you’ve misplaced it or are taking over a business, conducting an Arizona EIN search isn’t as complicated as it sounds. Here’s how you can do it:

1. Check Your Records

The first and easiest step is to check your business records. Your EIN should be on official documents like your business tax returns, bank statements, or payroll records. Look through your files carefully; it might just be hiding in plain sight.

If you're dealing with older documents, don’t panic. Sometimes EINs are listed under different names or formats, so double-check everything carefully.

2. Contact the IRS

If you can't find your EIN in your records, the IRS is your next stop. You can contact them directly by phone or mail to request a copy of your EIN assignment letter. They’ll need some basic information about your business, so have your details ready.

Pro tip: The IRS won’t give out an EIN over the phone, so make sure you follow their official procedures to avoid any issues.

3. Use Online Tools

In today’s digital age, there are plenty of online tools and resources to help you find your Arizona EIN. Websites like the IRS’s official portal or third-party services can guide you through the process. Just be cautious and stick to trusted platforms to avoid scams.

Common Mistakes to Avoid During an Arizona EIN Search

When searching for your Arizona EIN, it’s easy to make mistakes that could slow down the process. Here are a few common pitfalls to watch out for:

- Forgetting to Verify: Always double-check the EIN you find to ensure it’s correct. A single digit error can cause major problems.

- Using Unreliable Sources: Stick to official channels like the IRS or Arizona state websites. Avoid sketchy websites promising quick results for a fee.

- Not Documenting: Once you’ve found your EIN, make sure to store it in a secure place. You don’t want to go through this process again in the future.

By avoiding these mistakes, you’ll save yourself a lot of time and hassle. Remember, patience is key when dealing with government agencies and official documents.

Arizona EIN vs. FEIN: What’s the Difference?

You might have heard the term FEIN (Federal Employer Identification Number) tossed around. So, what’s the difference between an Arizona EIN and an FEIN? The short answer: there isn’t much of a difference.

An EIN and FEIN are essentially the same thing. The IRS uses the term EIN, while some states or businesses might refer to it as an FEIN. Both terms refer to the nine-digit number assigned by the IRS to businesses for tax purposes.

So, if someone asks for your FEIN in Arizona, they’re likely just referring to your EIN. Just make sure you’re clear on which number they’re asking for to avoid confusion.

Key Takeaways

Here’s a quick recap:

- EIN and FEIN are interchangeable terms.

- Both numbers serve the same purpose: identifying your business for tax purposes.

- Stick to using EIN when dealing with official IRS or state documents.

Steps to Apply for an Arizona EIN

If you’re starting a new business or need to apply for an EIN for any reason, here’s a step-by-step guide to help you through the process:

1. Determine Eligibility

Not every business needs an EIN. Generally, if you’re a sole proprietor with no employees, you might not need one. However, if you plan to hire staff or operate as a partnership or corporation, an EIN is a must.

2. Gather Required Information

Before applying, gather all necessary information about your business. This includes your legal name, business address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

3. Complete the Application

The IRS provides an online application process that’s quick and easy. Simply fill out Form SS-4, and you’ll receive your EIN within minutes. Alternatively, you can apply by mail or fax if you prefer a paper trail.

Pro tip: Double-check all information before submitting to avoid delays or errors.

Arizona EIN Search: Tips for Small Business Owners

Small business owners in Arizona face unique challenges when it comes to managing their EIN. Here are a few tips to help you stay organized:

- Keep Records Organized: Maintain a digital and physical file of all important documents, including your EIN assignment letter.

- Set Reminders: Use calendar alerts to remind yourself of important deadlines related to your EIN, such as tax filings or annual renewals.

- Consult Professionals: If you’re unsure about anything, don’t hesitate to reach out to a tax professional or accountant for guidance.

By following these tips, you’ll ensure your business stays compliant and runs smoothly.

Arizona EIN Search: Legal and Compliance Aspects

When it comes to EINs, compliance is key. Failing to properly manage your EIN can lead to legal issues, fines, or penalties. Here’s what you need to know:

Arizona businesses are required to report their EIN to both the IRS and state authorities. This ensures all tax obligations are met and helps prevent fraud or misuse of the number.

In addition, the IRS monitors EIN usage closely. If you suspect someone is misusing your EIN, report it immediately to avoid any legal consequences.

Staying Compliant

To stay compliant, make sure you:

- Regularly review your tax filings to ensure accuracy.

- Keep your EIN secure and only share it with trusted parties.

- Stay updated on any changes in tax laws or regulations affecting EINs.

Conclusion: Take Control of Your Arizona EIN Search

In conclusion, mastering the Arizona EIN search process is essential for any business owner or employee in the state. Whether you’re searching for your EIN or applying for a new one, understanding the steps and requirements will save you time and stress.

Remember, your EIN is more than just a number—it’s a vital part of your business’s identity. So, take the necessary steps to protect it and use it wisely.

Now, it’s your turn! Share your thoughts or experiences with Arizona EIN search in the comments below. And don’t forget to check out our other articles for more valuable insights on business management and finance.

Table of Contents

- What Exactly is an Arizona Employer Identification Number (EIN)?

- Why Do You Need an Arizona EIN?

- How to Conduct an Arizona EIN Search

- Common Mistakes to Avoid During an Arizona EIN Search

- Arizona EIN vs. FEIN: What’s the Difference?

- Steps to Apply for an Arizona EIN

- Arizona EIN Search: Tips for Small Business Owners

- Arizona EIN Search: Legal and Compliance Aspects

- Conclusion: Take Control of Your Arizona EIN Search

- Carey Grant The Timeless Icon Who Redefined Hollywood Glamour

- Danny Amezcua Mendola The Rising Star In The World Of Entertainment

Arizona unemployment filing process. The Meteor

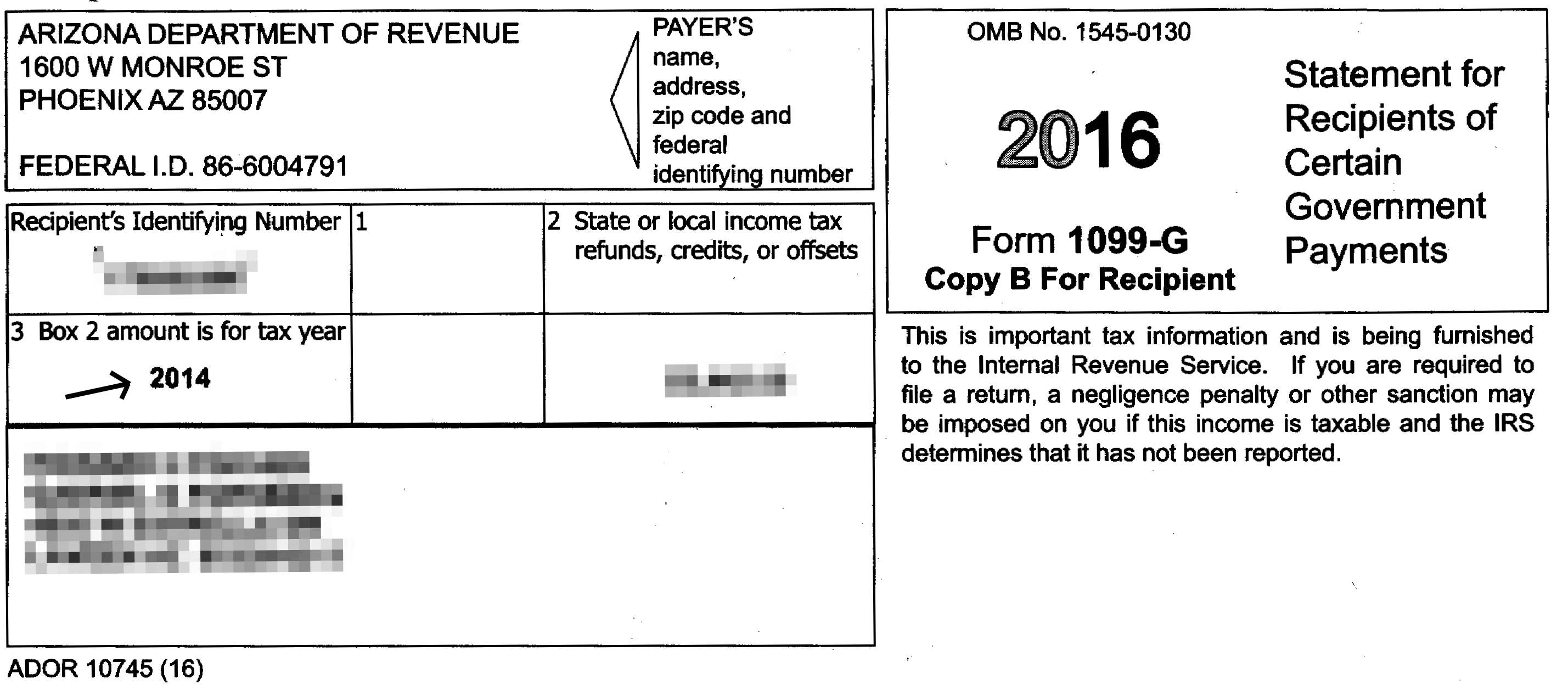

Arizona 1099 G Lookup

EIN Lookup How to Find Your Business Tax ID Number