ADX Range 13: The Hidden Gem For Traders And Investors

ADX Range 13 is one of the most talked-about topics in the trading world right now. Imagine this: you're sitting in front of your trading screen, staring at numbers and charts, trying to figure out what the market's next move will be. That's where ADX Range 13 comes in. It's like having a crystal ball that gives you hints about market trends and volatility. But don't get me wrong—it's not magic. It's all about understanding the tools and strategies that make this range so special.

For those who aren't familiar, ADX (Average Directional Index) is a technical indicator used to measure the strength of a trend. The "Range 13" refers to a specific time frame that traders focus on to identify opportunities. Now, why should you care? Because understanding ADX Range 13 can give you a competitive edge in the market. It's like knowing the secret ingredient in a recipe that makes everything taste better.

So, buckle up because we're diving deep into the world of ADX Range 13. Whether you're a seasoned trader or just starting out, this article will give you insights, strategies, and tips that you won't find anywhere else. Trust me, by the end of this, you'll be wondering why you didn't learn about this sooner.

- Lil Kim Before Surgery The Untold Journey Of A Hiphop Icon

- Cbx Border Crossing Ticket Your Ultimate Guide To Smooth Crossborder Travel

What Exactly is ADX Range 13?

Alright, let's break it down. ADX Range 13 isn't just some random number someone pulled out of thin air. It's a carefully calculated time frame that traders use to analyze market trends. The ADX indicator itself helps traders gauge the strength of a trend, but when you focus on the "Range 13," you're looking at a specific period that often reveals patterns and signals that are otherwise hard to spot.

Here's the deal: when the ADX reading is above 25, it indicates a strong trend. But when it's below 20, it suggests a weak or non-existent trend. The "Range 13" focuses on this specific area, giving traders a clearer picture of what's happening in the market. Think of it like a magnifying glass that helps you see the details you might otherwise miss.

Why ADX Range 13 Matters

Now, you might be wondering why ADX Range 13 is such a big deal. Well, it's all about timing. In trading, timing is everything. By focusing on this range, traders can better predict when a trend is about to start or end. It's like knowing when to enter or exit a trade at the perfect moment. And let's be real, that's the dream, right?

- Sam Elliott And His Son A Heartwarming Journey Of Legacy And Bonding

- Discover The Magic Of Nona Gaye Music A Journey Through Soulful Rhythms

Another reason ADX Range 13 is important is that it helps filter out noise. The market can be chaotic, with all kinds of factors influencing prices. But by zooming in on this specific range, traders can cut through the clutter and focus on what really matters. It's like tuning into the right frequency to get the clearest signal.

How to Use ADX Range 13 in Trading

Using ADX Range 13 effectively requires a bit of practice, but once you get the hang of it, it becomes second nature. Here's a step-by-step guide to help you get started:

- Set up your chart with the ADX indicator.

- Focus on the 13-period range to analyze trends.

- Look for crossovers and divergences to identify potential entry and exit points.

- Combine ADX Range 13 with other indicators for a more comprehensive analysis.

Remember, trading is all about strategy. ADX Range 13 is just one tool in your toolbox, but when used correctly, it can make a huge difference.

Combining ADX Range 13 with Other Indicators

While ADX Range 13 is powerful on its own, it becomes even more effective when combined with other indicators. For example, pairing it with Moving Averages or RSI (Relative Strength Index) can give you a more complete picture of the market. It's like having a backup plan that ensures you're making informed decisions.

Here's a quick tip: when ADX Range 13 shows a strong trend, but RSI indicates overbought or oversold conditions, it might be time to reconsider your position. It's all about balance and context. No single indicator can give you all the answers, but together, they can paint a pretty clear picture.

Understanding Market Trends with ADX Range 13

Market trends are the lifeblood of trading, and ADX Range 13 can help you understand them better. By focusing on this range, you can identify whether the market is trending, consolidating, or reversing. And that knowledge is power.

For example, if the ADX reading is consistently above 25 in the 13-period range, it suggests a strong trend. But if it's hovering around 20 or below, it might indicate a sideways market. Knowing the difference can help you adjust your strategy accordingly.

Identifying Breakouts and Reversals

One of the coolest things about ADX Range 13 is its ability to spot breakouts and reversals. These are critical moments in trading where the market shifts direction, and being able to identify them early can be a game-changer.

Here's how it works: when the ADX reading starts to rise in the 13-period range, it could signal the start of a new trend. Conversely, if it starts to fall, it might indicate the end of a trend. By paying attention to these signals, you can position yourself for success.

Common Mistakes to Avoid with ADX Range 13

Even the best tools can lead to mistakes if not used properly. Here are a few common pitfalls to watch out for when using ADX Range 13:

- Over-reliance on the indicator: Remember, ADX Range 13 is just one piece of the puzzle. Don't ignore other factors that could influence the market.

- Ignoring context: Market conditions can change rapidly, so always consider the bigger picture before making decisions.

- Timing errors: Entering or exiting a trade too early or too late can cost you. Be patient and let the signals confirm before acting.

By avoiding these mistakes, you can maximize the effectiveness of ADX Range 13 and improve your trading results.

Staying Disciplined

Discipline is key in trading, and using ADX Range 13 is no exception. It's easy to get caught up in the excitement of a potential trade, but sticking to your plan is crucial. Set clear entry and exit points, and don't let emotions cloud your judgment.

Here's a pro tip: keep a trading journal. Write down your thoughts, decisions, and outcomes for each trade. Over time, you'll start to see patterns and areas where you can improve. It's like having a personal coach that helps you stay on track.

Real-World Examples of ADX Range 13 in Action

Talking about ADX Range 13 is one thing, but seeing it in action is another. Let's look at a couple of real-world examples to see how this tool can make a difference:

Example 1: In 2020, during the early stages of the pandemic, the stock market was extremely volatile. Traders who used ADX Range 13 were able to identify key trends and make informed decisions, even in uncertain times.

Example 2: In the cryptocurrency market, ADX Range 13 has been used to spot trends in Bitcoin and other digital assets. By focusing on this range, traders were able to capitalize on price movements and generate profits.

Case Studies

Case studies are a great way to learn from others' experiences. Here's one that stands out:

A trader named John used ADX Range 13 to analyze the forex market. By focusing on this range, he was able to identify a strong trend in the EUR/USD pair. He entered the trade at the perfect moment and rode the trend all the way to a profitable exit. It's stories like these that show the power of ADX Range 13.

Best Practices for Using ADX Range 13

Now that you know the basics, here are some best practices to keep in mind:

- Practice on a demo account before going live. This will help you get comfortable with the tool without risking real money.

- Stay updated on market news and events that could impact your trades.

- Continuously educate yourself on trading strategies and techniques.

Trading is a journey, and the more you learn, the better you'll become. ADX Range 13 is just one part of that journey, but it's a valuable one.

Continuous Learning

Never stop learning. The market is constantly evolving, and so should your strategies. Attend webinars, read books, and follow industry experts to stay ahead of the curve. Remember, the more knowledge you have, the better equipped you'll be to make smart trading decisions.

Conclusion

ADX Range 13 is a powerful tool that can give traders a significant edge in the market. By understanding its mechanics and applying it effectively, you can identify trends, spot opportunities, and make informed decisions. But remember, it's just one tool in your arsenal. Combine it with other indicators and strategies to create a comprehensive approach to trading.

So, what are you waiting for? Start exploring ADX Range 13 today and see how it can transform your trading game. And don't forget to share your experiences in the comments below. We'd love to hear how you're using this tool to achieve success. Happy trading!

Table of Contents

ADX Range 13: The Hidden Gem for Traders and Investors

How to Use ADX Range 13 in Trading

Combining ADX Range 13 with Other Indicators

Understanding Market Trends with ADX Range 13

Identifying Breakouts and Reversals

Common Mistakes to Avoid with ADX Range 13

Real-World Examples of ADX Range 13 in Action

Best Practices for Using ADX Range 13

- Progressive Insurance Refund A Deep Dive Into Getting Your Money Back

- M C Smith Funeral Home Obituaries Your Ultimate Guide To Remembering Lives

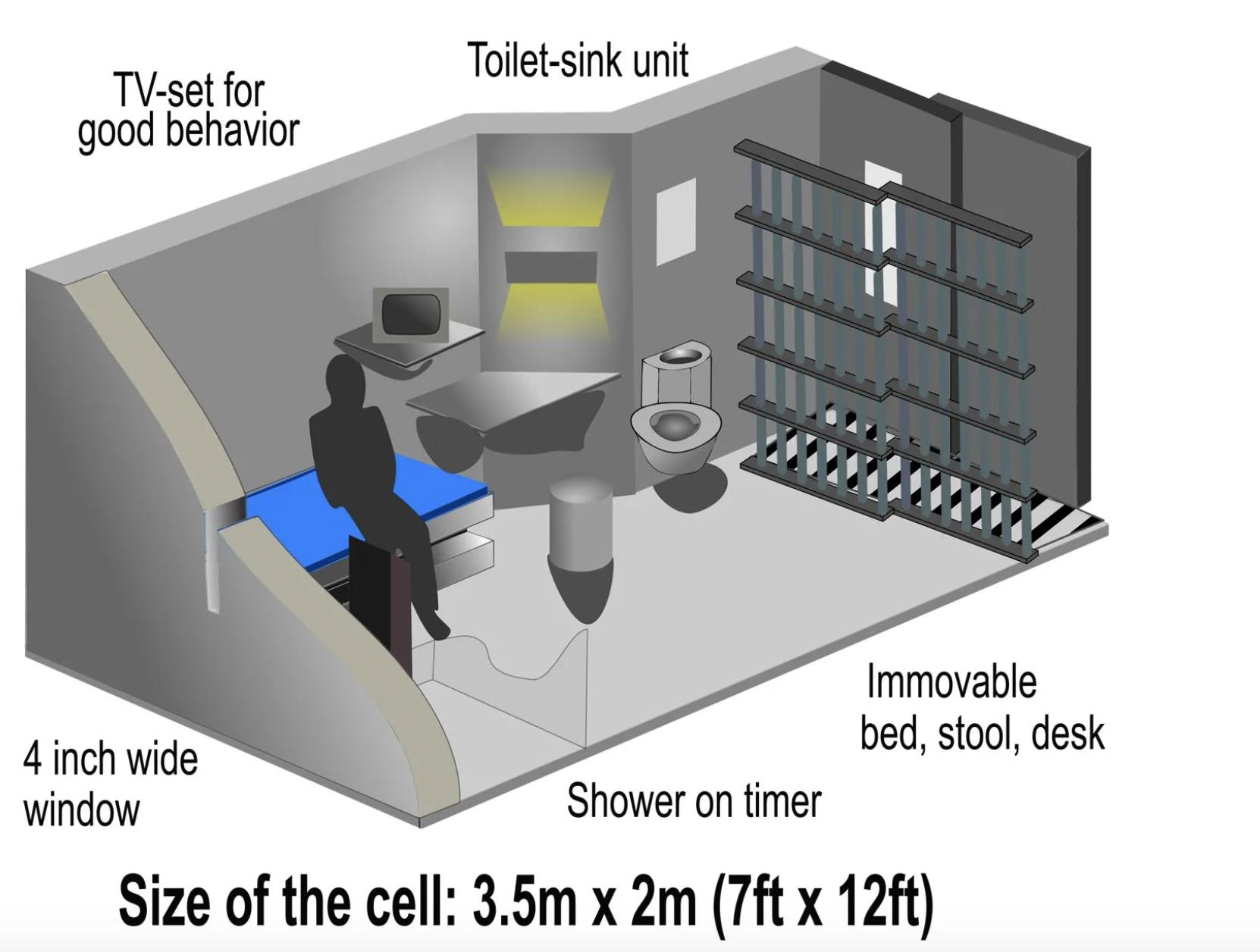

Keegan Hamilton on Twitter "Here's a description of Range 13 at ADX

'El Chapo' at ADX Florence Business Insider

'El Chapo' at ADX Florence Business Insider